Adecco Group Swiss Job Market Index Q2 2025: decline in jobs continues – only healthcare and care professions on the rise

The Swiss job market is cooling off again: in the second quarter of 2025, the number of job vacancies fell by 1% compared with the previous quarter and 3% compared with the same quarter in the previous year. IT, administration and commercial professions were particularly affected. By contrast, demand in the healthcare and care fields remains robust. This is shown by the Adecco Group Swiss Job Market Index, a scientifically substantiated study conducted by the Adecco Group Switzerland and the Swiss Job Market Monitor of the University of Zurich.

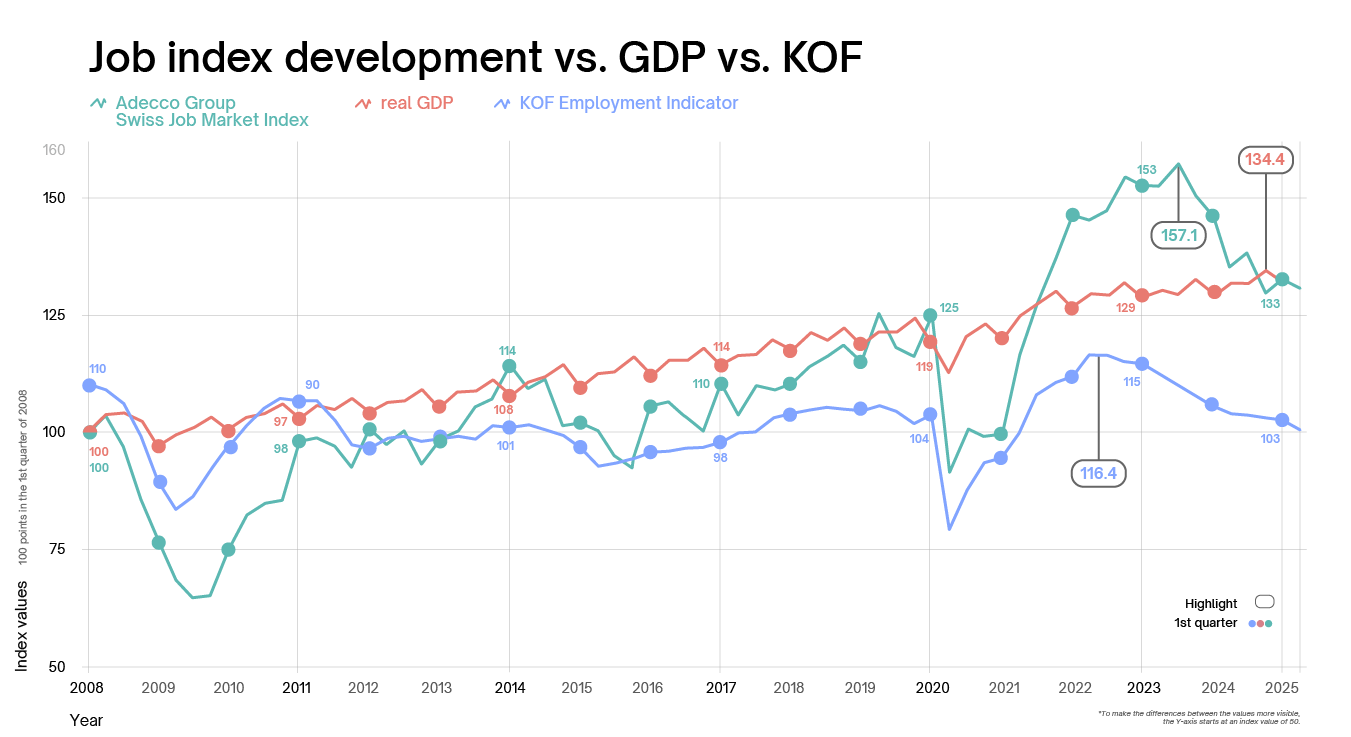

Sources: KOF Swiss Economic Institute (KOF Employment Indicator), State Secretariat for Economic Affairs (SECO; real GDP), Swiss Job Market Monitor (SMM; Adecco Group Swiss Job Market Index).

NB: an Adecco Group Swiss Job Market Index or GDP value over 100 indicates an increase and a value under 100 indicates a decrease compared with the base quarter of Q1 2008. A KOF Employment Indicator value over 100 means that more companies are planning to create rather than cut jobs. If the value is under 100, job cuts are predominantly planned.

After moderate recovery in the job market during the first quarter of 2025, in the second quarter the Adecco Group Swiss Job Market Index recorded a slight decline in the number of job vacancies, namely -1% compared with the previous quarter (Q1 2025). Year-on-year (Q2 2024), the decline was -3%. This subdued trend was confirmed by the KOF Employment Indicator, which shows that companies are not currently planning either recruitment or downsizing measures.

‘The Swiss economic situation remains strained due to protectionist US tradepolicy, global uncertainty and weak investment activity. The declining JobMarket Index and the KOF Employment Indicator both note stagnation on theSwiss job market, also reflected in increasing unemployment and reticentemployment development. According to KOF, moderate recovery to theeconomic environment and thus the job market can be expected no earlier thanthe end of the year.’

Marcel Keller, Country President Adecco Group Switzerland

Professional group focus

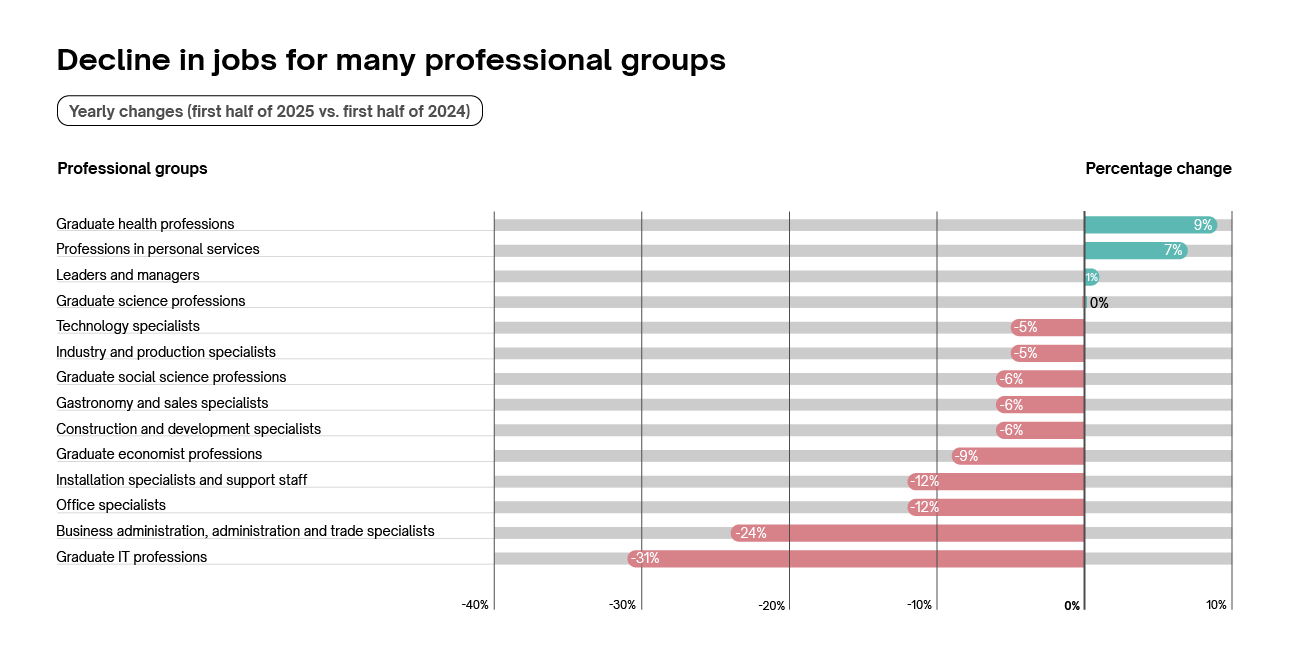

The evaluations focusing on specific professional groups are based on a comparison between job vacancies in the first half of 2025 (Q1 and Q2) and in the first half of 2024. This half-year comparison enables better smoothing of seasonal variation than a quarterly comparison could achieve.

German-speaking Switzerland records bigger job market slump than French-speaking and Italian-speaking Switzerland

The number of job vacancies were down for the first half of 2025 compared to the first half of the previous year in both German-speaking Switzerland (-7%) and French-speaking and Italian-speaking Switzerland (-2%), with German-speaking Switzerland seeing a relatively greater drop in job advertisements comparable to the national average (-7%). In French-speaking and Italian-Speaking Switzerland, the canton of Vaud in particular had a stabilising effect as one of the linguistic region’s economic drivers alongside Geneva, despite the stunted economic situation. Key sectors in the canton of Vaud are microtechnology and nanotechnology, precision industry, nutrition, ICT, cleantech, life sciences and international sports organisations. Recent surveys have shown positive development in Vaud’s IT and hotel sectors, with issues in industry and gastronomy due to falling demand and a skills shortage.

Broad decline in jobs across almost all professional groups – with only a few exceptions

The Swiss job market saw a largely downward trend in the first half of 2025 compared with the first half of the previous year, both regionally and in terms of specific professions. Only three of the 14 professional groups saw a rise in jobs compared with the same period in the previous year: graduate health professions (+9%; e.g. doctors and qualified nursing staff), professions in personal services (+7%; e.g. midwifery specialists, opticians, caretakers, firefighters) and managers (+1%). Graduate science professions (e.g. chemists, bioscientists, engineers), on the other hand, did not see any change in the number of job vacancies in the first half of 2025 compared with 2024.

Professional groups with a drop in job vacancies were graduate IT professions (-31%; e.g. software developers, database and network specialists) and business administration, administration and trade specialists (-24%; e.g. sales specialists, accounting specialists). Office specialists (e.g. secretarial staff, telephone operators) and installation specialists and support staff (e.g. equipment and machinery operators, bus drivers and tram drivers) also saw a drop of 12% each, followed by graduate economist professions (e.g. financial analysts, marketing and advertising specialists) with a drop of 9%. Construction and development specialists (e.g. joiners, heating and ventilation fitters), gastronomy and sales specialists (e.g. service assistants, chefs and sales specialists) and graduate social science professions (e.g. teachers, lawyers) all saw a drop of 6% in job vacancies in the first half of 2025 compared with the same period in the previous year. Technology specialists (e.g. mechanical engineers, air traffic controllers) and industry and production specialists (e.g. polymechanics, watchmakers) similarly saw a drop in job vacancies of 5% each.

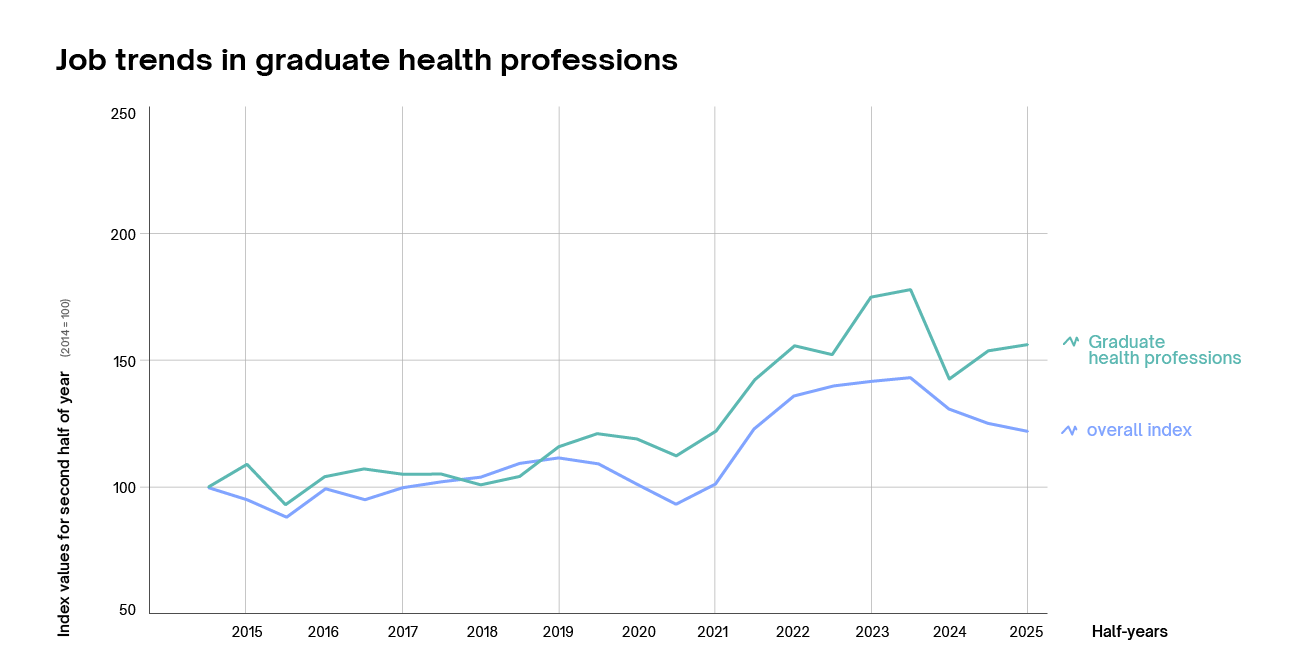

Graduate health professions: healthcare jobs still on the rise, qualified nursing staff and doctors particularly in demand

Graduate health professions (e.g. nursing experts, medical therapists or health researchers) saw a 9% rise in job vacancies in the first half of 2025 compared with the first half of 2024. This continues their overall positive job development in recent years, despite occasional drops in demand during 2024, remaining at a significantly higher level than before the coronavirus pandemic. As in every year since the pandemic, the increase in the first half of 2025 was primarily down to the sub-group of qualified nursing staff and doctors. According to the Adecco Skills Shortage Index, these currently have the highest skills shortage (first place).

Strong demand for staff in health professions, especially for qualified nursing staff and doctors, is likely to be largely structural and is affected by at least three factors. Firstly, societal ageing has created increased demand for healthcare services and thus also staff. At the same time, the retirement of the baby-boomer generation has resulted in numerous specialists leaving working life, including in healthcare, further increasing the number of vacant positions. Secondly, continuing population growth in Switzerland has increased demand for healthcare services and thus also staff. Thirdly, an ongoing skills shortage in healthcare means that current positions are remaining vacant and need to be advertised repeatedly. Persistently poor working conditions are also exacerbating the skills shortage.

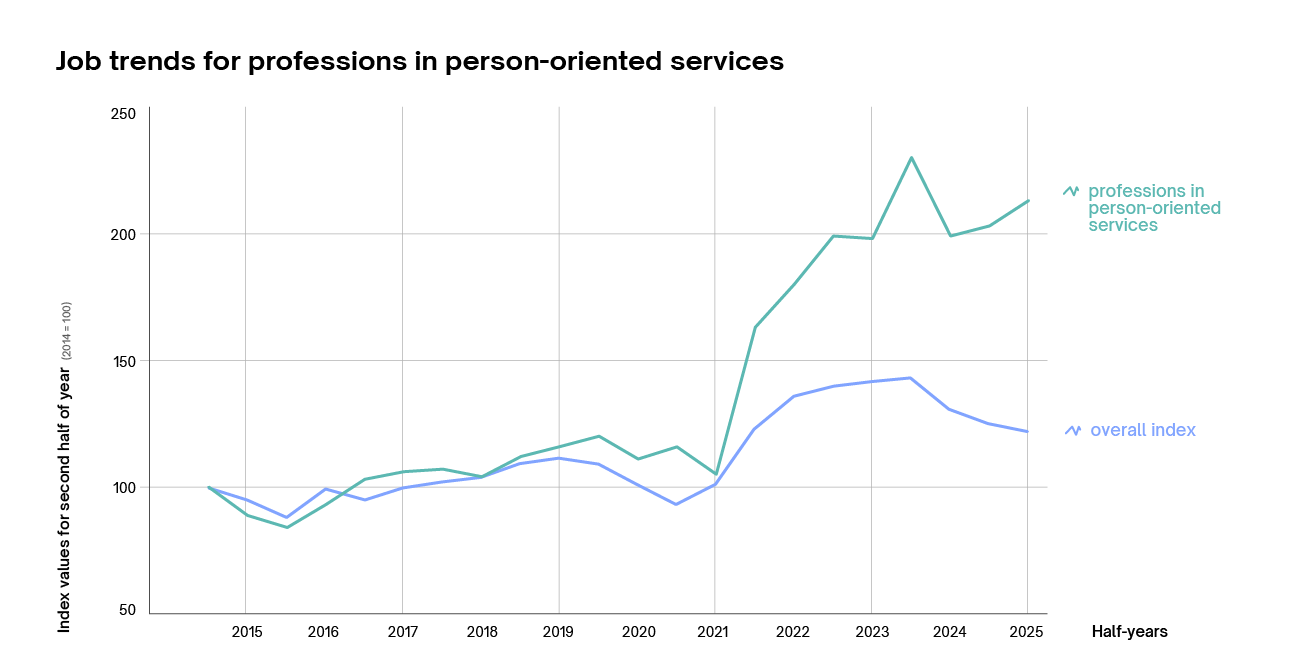

Professions in personal services: continuing high demand

Professions in personal services (e.g. beauticians, medical assistants) saw a 7% increase in jobs in the first half of 2025 compared with the first half of 2024. This continues a trend of above-average growth that has been ongoing since 2021. This rise is primarily due to an increase in job vacancies for assistance roles in healthcare (e.g. medical assistants, intermediate-level healthcare and nursing specialists) and nursing professions (e.g. nursing specialists, nursing assistants, nursing professions in healthcare).

Like graduate health professions, the rise in job vacancies within this group is down to various structural factors. First of all, a worsening skills shortage, high staff turnover and stressful working conditions are exacerbating the staffing situation. Secondly, demand for healthcare and childcare specialists is increasing due to demographic change and immigration, especially the arrival of well-qualified individuals with high family care needs. As studies have shown, the immigration of highly qualified workers increases the job prospects of less qualified workers, for example by increasing demand for schools and daycare centres. This could also be behind the increased demand for jobs in other sub-groups such as protective services and security staff (police officers and security services personnel) and other professions in personal services (hairdressers, beauticians).

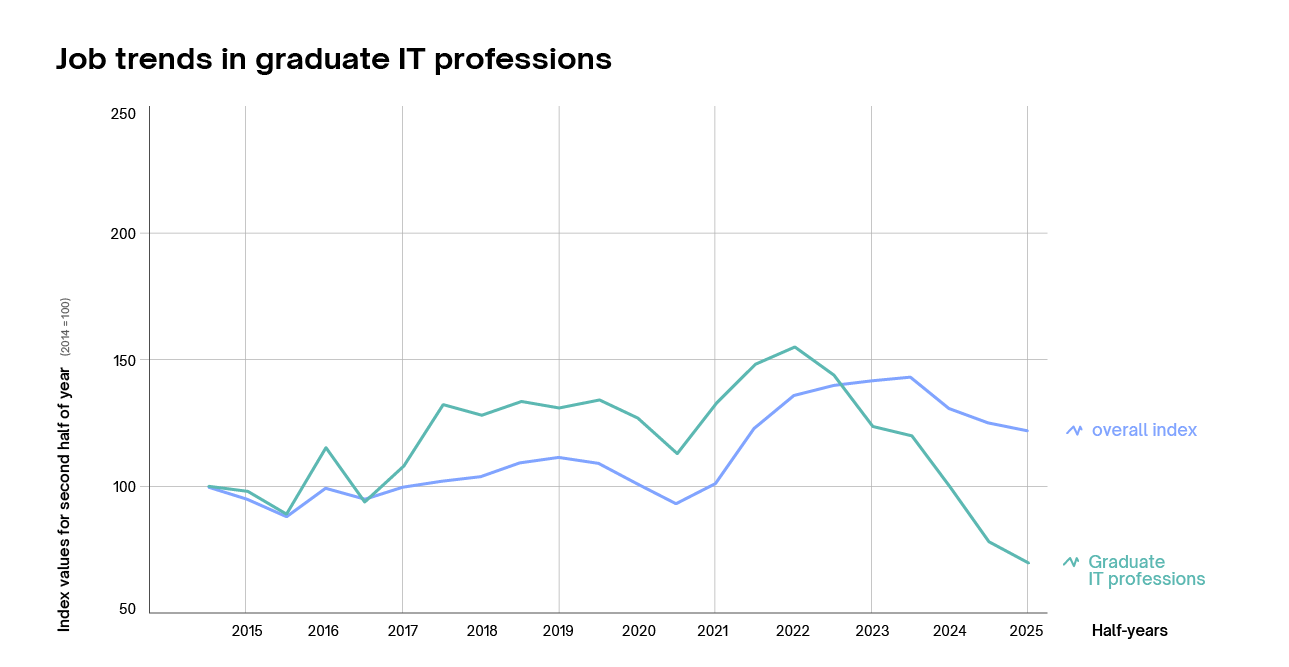

Graduate IT professions: strong decline in IT professions – economy and AI to blame

Graduate IT professions (e.g. software developers, IT architects, data analysts) saw the biggest drop in job advertisements in the first half of 2025 compared with the first half of 2024, at -31%. This applies equally to developers and analysts of software and applications, and to database and network specialists. The number of job vacancies in this sector has fallen by more than half since the middle of 2022 – after a boom in demand in 2020–2022, it is now below even 2014–2015 levels.

The drop in job demand since mid-2022 is partly due to the economic downturn. Global uncertainty, increased costs and weakened export markets have resulted in Swiss companies being reluctant to make investments, including in digitalisation projects, after a surge in digitalisation in 2020–2022 due to the pandemic. This indicates a level of normalisation in the labour market, although without completely negating the skills shortage, for example for developers and analysts.

Secondly, automation and artificial intelligence are fundamentally changing professional realities and requirements in IT professions. Even in 2023, around 34% of major Swiss companies were using AI, with the trend increasing. Automation and AI enable many programming and analysis tasks to be completed more efficiently, curbing demand for additional staff. At the same time, the cloud solutions and IT outsourcing deployed by Swiss companies are reducing demand for internal network and database specialists.

‘Whether the current decline in IT jobs is just temporary or indicates structural change remains to be seen. However, one thing is clear: automation and AI are having an increasing impact on the requirements of ICT professions. Companies that take these developments into account early on could secure long-term advantages in the race for skilled labour.’

Johanna Bolli-Kemper, Swiss Job Market Monitor

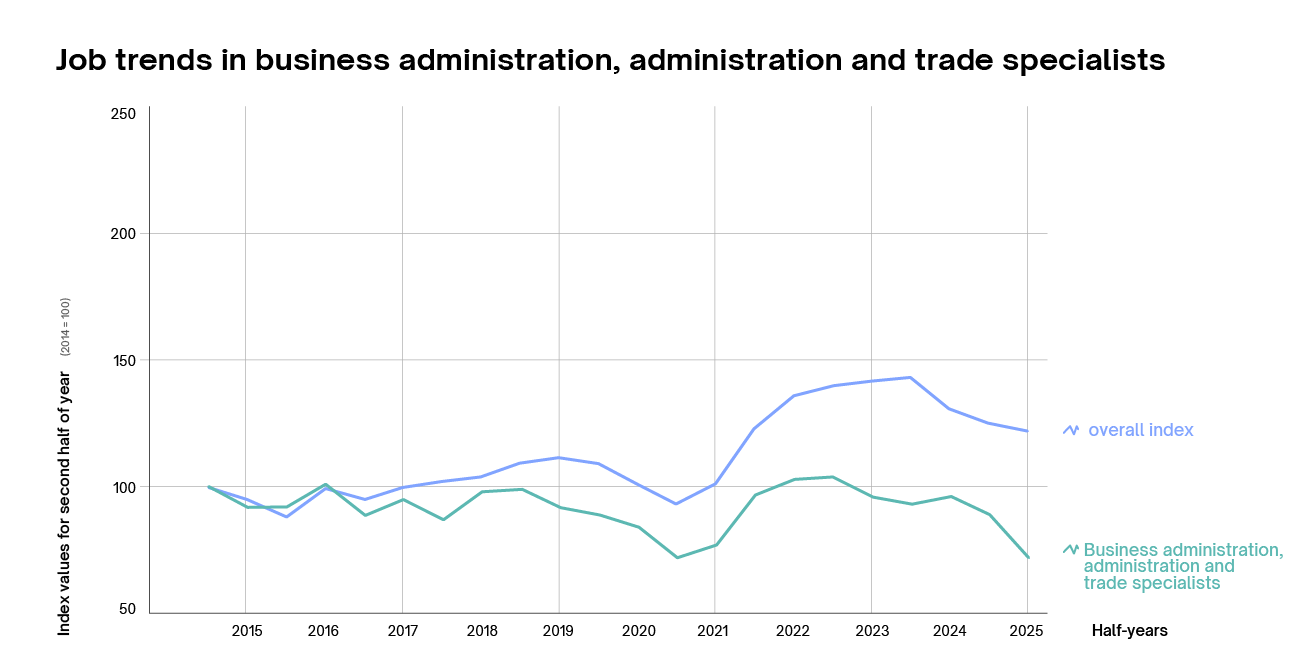

Business administration, administration and trade specialists: technological structural change impacts demand for BA and administration professions

Business administration, administration and trade specialists (e.g. clerks, administrative staff or commercial sales specialists) saw a significant decline of 24% in job advertisements in the first half of 2025 compared with the first half of 2024. This is a broad decline spread across all sub-groups: finance and mathematical process professionals, skilled business, commercial, administrative and sales workers, purchasers and brokers. It continues the downward trend that has been ongoing since mid-2023 and has now reached a new low since the index series launched in 2014/15.

Like graduate IT professions, the falling demand for business administration, administration and trade specialists is likely primarily due to both economic and technological developments, such as the ongoing digitalisation and automation of business processes. An increasing number of Swiss companies are using digital technologies such as AI, cloud computing and big data. As many activities in this professional group involve considerable amounts of standardised, repetitive or routine tasks, they can increasingly be automated more effectively using software and AI, whilst strategic and analytical skills are becoming more important. Given this, it is no surprise that this professional group has seen a structural drop in demand since the second half of 2016, despite temporary periods of recovery such as in 2021–2022.

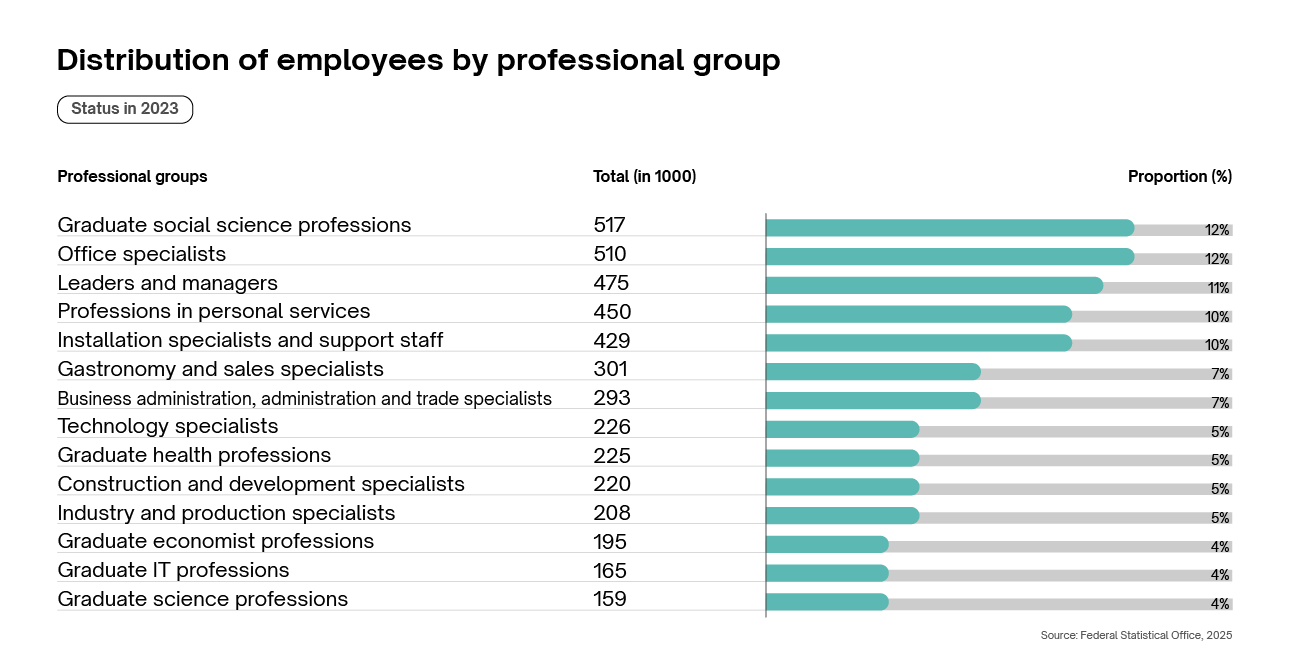

Extra information: proportion of employees by professional group

The table below shows the distribution of employees in Switzerland according to the 14 professional groups described in this report. The aim is to provide an overview of the size of the professional groups in Switzerland. The data comes from the Swiss Federal Statistical Office and relates to 2023.