Full-year 2011 HIGHLIGHTS

-

Revenues of EUR 20.5 billion, up 10% organically1

-

Gross margin at 17.4%, down 40 bps (-60 bps organically)

-

SG&A up 6% in constant currency (+4% organically)

-

EBITA2 of EUR 814 million, up 13% (+14% in constant currency and organically)

-

EBITA margin of 4.0%, up 10 bps (4.1% before EUR 20 million integration costs for MPS and DBM)

-

Net income attributable to Adecco shareholders of EUR 519 million, up 23%

-

Strong operating cash flow of EUR 524 million, up 15% (EUR 455 million in 2010)

-

Increased pay-out ratio leading to a proposed dividend of CHF 1.80 per share, up 64%

Fourth quarter 2011 HIGHLIGHTS

-

Revenues of EUR 5.2 billion, up 3% organically

-

Gross margin of 17.9%, flat year-on-year, but up 70 bps sequentially (+50 bps organically)

-

SG&A well controlled, flat sequentially on an organic basis and excluding integration costs

-

EBITA margin of 4.2%, flat year-on-year (4.4% before EUR 12 million integration costs for DBM)

Key figures for 2011

|

in EUR millions |

FY 2011 |

Q4 2011 reported |

FY 2011 organic growth |

Q4 2011 organic growth |

|

|---|---|---|---|---|---|

|

Revenues |

20,545 |

5,194 |

+10% |

+3% |

|

|

Gross profit |

3,566 |

930 |

+6% |

+1% |

|

|

EBITA |

814 |

217 |

+14% |

+3% |

|

|

Operating income |

763 |

206 |

|||

|

Net income attributable to Adecco shareholders |

519 |

133 |

Adecco Group, the worldwide leader in Human Resource services, today announced results for the full year and Q4 2011. Revenues in 2011 were EUR 20.5 billion, an increase of 10% on an organic basis. The gross margin was 17.4%, down 60 bps year-on-year organically. Strong cost control resulted in only a 4% organic increase of SG&A in 2011. EBITA increased 14% organically compared to 2010, while the EBITA margin was 4.0%, up 10 bps year-on-year. The Group generated strong operating cash flow of EUR 524 million in 2011. The proposed dividend per share for 2011 is CHF 1.80, an increase of 64% compared to the dividend paid per share for 2010.

Patrick De Maeseneire, CEO of the Adecco Group said:

“In 2011 we achieved double-digit organic revenue growth for the second consecutive year. General staffing, especially the industrial segment, continued to lead growth, while professional staffing growth remained moderate. Geographically, Germany & Austria, Italy and Emerging markets all grew strongly double-digit. France grew 10% and North America was up 8% organically. Japan and Benelux grew slower, but performed better than the market. UK & Ireland and Iberia were clearly more challenging markets, with the latter facing declining revenues in the second half of 2011. With unemployment at high levels, scope for price increases was limited, and the gross margin was impacted by the business mix. Nevertheless, we continued to be disciplined and kept costs under tight control, leading to solid EBITA growth of 14% organically and an EBITA margin of 4.1% before integration costs. We continue to watch developments carefully and keep enhancing our profitability. In current times, our clients need flexibility and we have the right offering for them. With the good results achieved in 2011, continued price discipline and strict cost management, we are on track to reach our 5.5% EBITA margin target, midterm.”

FY 2011 FINANCIAL PERFORMANCE

The results of the acquired business of Drake Beam Morin Inc., (“DBM”) are included since September 1, 2011.

Revenues

Group revenues for 2011 were EUR 20.5 billion, an increase of 10% or 11% in constant currency compared to the prior year. Organically revenues were up 10% in 2011. Permanent placement revenues amounted to EUR 344 million, an increase of 20% in constant currency (+18% organically). Revenues from the counter-cyclical career transition (outplacement) business totalled EUR 206 million, a decline of 6% in constant currency or 16% organically.

Gross Profit

In 2011, gross profit was EUR 3.6 billion, an increase of 7% compared to 2010. Organically, gross profit increased by 6%. The gross margin was 17.4%, 40 bps lower than in 2010. Acquisitions added 20 bps to the gross margin in 2011. The negative impact from the French payroll tax subsidy cut was mitigated during 2011 through price increases, so that the impact at the Group level was negligible for the full year.

Selling, General and Administrative Expenses (SG&A)

SG&A increased by 6% compared to 2010 or by 4% organically. Integration costs for MPS and DBM amounted to EUR 20 million in 2011 (EUR 33 million for MPS and Spring in 2010). At year end 2011 the Adecco Group had over 33,000 FTE employees worldwide and a network of over 5,500 branches. Compared to year end 2010, on an organic basis, FTE employees were up 3% and branches were up by 1%.

EBITA

In 2011, EBITA improved by 13% to EUR 814 million. On an organic basis, EBITA increased by 14%. The EBITA margin was up 10 bps to 4.0%.

Amortisation of Intangible Assets

Amortisation was EUR 51 million in 2011, compared to EUR 55 million in 2010.

Operating Income

Operating income in 2011 was EUR 763 million, compared to EUR 667 million in 2010.

Interest Expense and Other Income / (Expenses), net

Interest expense was EUR 71 million in the period under review, which compares to EUR 63 million in 2010. Other income / (expenses), net was an expense of EUR 6 million in 2011, compared to a net expense of EUR 1 million in 2010. Interest expense is expected to be around EUR 80 million for the full year 2012.

Provision for Income Taxes

The effective tax rate for 2011 was 24% compared to 30% in 2010. The tax rate for 2011 was positively impacted by the reduction in withholding tax payable upon the distribution of dividends due to the ratification of the Swiss-Japanese tax treaty. The successful resolution of prior years’ tax audits in several jurisdictions in both years also positively impacted the tax rate.

Net Income attributable to Adecco shareholders and EPS

In 2011, net income attributable to Adecco shareholders was EUR 519 million (2010: EUR 423 million). Basic EPS was EUR 2.72 (EUR 2.20 in 2010).

Cash-flow, Net Debt 3 and DSO

Operating cash flow amounted to EUR 524 million in 2011. The Group invested EUR 148 million for DBM and EUR 109 million in capex in 2011. Dividends paid were EUR 149 million in 2011. Net debt at the end of December 2011 was EUR 892 million compared to EUR 751 million at year end 2010. In 2011, DSO was 55 days compared with 54 days in 2010.

Currency Impact

In 2011, currency fluctuations had a negative impact on revenues of approximately 1%.

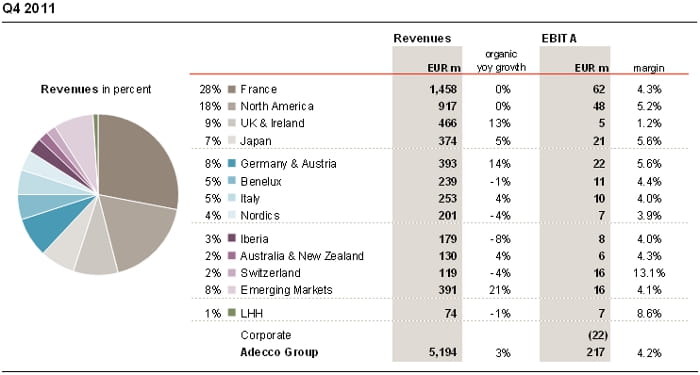

Q4 2011 FINANCIAL PERFORMANCE

Revenues

Group revenues in Q4 2011 were EUR 5.2 billion, an increase of 4% in EUR and in constant currency compared to Q4 2010. Organically, revenues were up 3%. Permanent placement revenues increased 7% in constant currency to EUR 82 million, while revenues from the counter-cyclical career transition (outplacement) business totalled EUR 64 million, a decline of 6% organically.

Gross Profit

In Q4 2011, gross profit amounted to EUR 930 million and the gross margin was 17.9%, flat compared to Q4 2010. DBM added 30 bps to the gross margin this quarter. The temporary staffing business had a negative impact on the gross margin of 40 bps in Q4 2011. Permanent placement had a positive impact of 10 bps on the Q4 2011 gross margin, whereas the impact was +30 bps from the career transition business (neutral when excluding DBM). Sequentially, the gross margin was up 70 bps (+50 bps excluding DBM).

Selling, General and Administrative Expenses (SG&A)

SG&A in Q4 2011 amounted to EUR 713 million, an increase of 4% in EUR and in constant currency or 1% organically compared to Q4 2010. Sequentially, SG&A was flat on an organic basis and when excluding integration costs. Costs related to the integration of DBM totalled EUR 12 million in Q4 2011 (EUR 12 million for MPS and Spring in Q4 2010). Organically, FTE employees increased by 3% (+950), compared to the fourth quarter of 2010. Sequentially, the number of FTE employees organically was unchanged. On an organic basis, the branch network expanded by 1% (+65 branches) compared with Q4 2010.

EBITA

In the period under review, EBITA was EUR 217 million, up 3% in EUR, in constant currency and organically compared with the fourth quarter of 2010. The Q4 2011 EBITA margin was 4.2%, flat compared with Q4 2010.

Amortisation of Intangible Assets

Amortisation of intangible assets in Q4 2011 was EUR 11 million compared to EUR 14 million in Q4 2010.

Operating Income

In Q4 2011, operating income was EUR 206 million. This compares to EUR 197 million in the fourth quarter of 2010.

Interest Expense and Other Income / (Expenses), net

The interest expense amounted to EUR 20 million in the period under review, EUR 5 million higher than in Q4 2010. Other income / (expenses), net was an income of EUR 3 million in Q4 2011 compared to an expense of EUR 1 million in the fourth quarter of 2010.

Net Income attributable to Adecco shareholders and EPS

In the period under review, net income attributable to Adecco shareholders was EUR 133 million. This compares to EUR 141 million in Q4 2010. Basic EPS in Q4 2011 was EUR 0.71 (Q4 2010: EUR 0.73).

Currency Impact

In Q4 2011, currency fluctuations had no impact on revenues.

SEGMENT PERFORMANCE

Revenues in France amounted to EUR 1.5 billion, flat compared to Q4 2010. Revenues were flat year-on-year in the industrial staffing segment, still running against a high comparison base and further slowing from the 7% growth rate in Q3 2011, while professional staffing continued to grow double-digit. Permanent placement revenues were up 22%. In the quarter under review EBITA was EUR 62 million compared to EUR 57 million in Q4 2010. The EBITA margin was 4.3% in Q4 2011, up 40 bps compared to Q4 2010. The good performance in renegotiating client contracts meant that Adecco in France recovered around 90% of the negative impact from the payroll tax subsidy cut for the full year 2011, ahead of initial expectations, so that the negative impact on the FY 2011 French gross margin was less than 10 bps.

In order to further strengthen the Group’s position in France and to ensure sustainable profitability, Adecco is informing and consulting the French Works Councils on its plans to unite the networks of Adecco and Adia under the Adecco brand. Combining the expertise of both general staffing businesses under a single roof would facilitate an even better offering for clients, candidates and colleagues. At the same time, the cost base would be further optimised through the planned reduction of over 500 full time equivalents (FTEs) and further branch network and shared service centre consolidation. Adecco expects to invest approximately EUR 45 million, the majority of which would be incurred during the second half of 2012.

In North America, Adecco generated revenues of EUR 917 million, flat in constant currency compared to Q4 2010. General staffing revenues grew by 2% in constant currency. Professional staffing revenues declined by 2% year-on-year, held back by the IT staffing business and with the Engineering & Technical segment comparing against very strong growth in Q4 2010 (Q4 2010 +36% organically vs. Q4 2011 -1% in constant currency). Finance & Legal and Medical & Science continued to report positive growth. Whereas the profitability in the IT professional staffing business was strong, revenue developments remained short of expectations. In the quarter under review, permanent placement revenues increased by 14% in constant currency. EBITA was up 21% in constant currency to EUR 48 million. The EBITA margin was 5.2% up 90 bps compared to Q4 2010. Note that integration costs related to MPS amounted to EUR 8 million in Q4 2010.

In the UK & Ireland, revenues were up 13% in constant currency to EUR 466 million, driven by new client wins. Permanent placement revenues were up 5% in constant currency. Business in the public sector, which accounted for 10% of the revenues in the UK & Ireland, continued to be difficult. EBITA was EUR 5 million in the quarter under review and the EBITA margin was 1.2%, up 10 bps compared to Q4 2010. Integration costs related to Spring and MPS amounted to EUR 4 million in Q4 2010.

In Japan, revenues increased by 5% in constant currency to EUR 374 million. The EBITA margin was 5.6%, up 60 bps when compared to Q4 2010. Adecco in Japan continued to benefit from outsourcing contracts won in 2010 and 2011. At the beginning of January 2012, Adecco acquired VSN Inc., a leading provider of professional staffing services in Japan. VSN Inc. doubles the exposure to professional staffing of Adecco in Japan and reinforces Adecco’s strong position in this attractive structural growth market. Results of VSN Inc. will be included as of January 2012.

In Germany & Austria, revenue growth continued to be solid and ahead of the market. Revenues increased by 14% to EUR 393 million, or by 17% when adjusted for the fewer working days in Q4 2011. The industrial staffing business continued to grow double-digit. The office segment grew 3% and professional staffing was up 15% year-on-year. EBITA amounted to EUR 22 million and the EBITA margin was 5.6%, as anticipated impacted by fewer working days in the fourth quarter of 2011 compared to the same period in 2010. Additionally, salary increases in accordance with the collective wage agreement and effective as of November 2011, impacted profitability in Q4 2011 due to the time lag of renegotiating client contracts. This will no longer have a negative impact in Q1 2012.

In Q4 2011, revenues in Benelux decreased by 1%. Revenue development was slightly behind the market in the Netherlands, but ahead of the market in Belgium. The EBITA margin was 4.4% in the quarter under review.

Revenue growth in Italy slowed to 4% in Q4 2011, comparing against a quarter with very strong growth in 2010 of 35%. Demand was also impacted by the economic uncertainties in the country. Italy achieved an EBITA margin of 4.0% in Q4 2011, down 90 bps year-on-year.

Revenues in the Nordics were down 4% in constant currency. Revenue growth in Sweden was still positive in Q4 2011, while revenues in Norway declined year-on-year, both in constant currency. The EBITA margin in Q4 2011 was 3.9%.

In Iberia revenues declined by 8% as economic conditions in the region remained difficult. Revenues in Australia & New Zealand were up 4% in constant currency this quarter with a very solid EBITA margin of 4.3%, up 160 bps compared to Q4 2010. In Switzerland revenues declined by 4% in Q4 2011 in constant currency, while profitability remained stellar with an EBITA margin of 13.1%.

Emerging Markets continued to deliver very strong revenue growth of 21% in constant currency. The EBITA margin was 4.1%, up 80 bps compared to the prior year.

Revenues of Lee Hecht Harrison (LHH), Adecco’s career transition and talent development business, were EUR 74 million, up 32% compared to Q4 2010 in constant currency and down 1% organically. EBITA was EUR 7 million and the EBITA margin was 8.6%. Results of the acquired company Drake Beam Morin Inc. (DBM) were included for the full quarter. In Q4 2011, integration related costs for DBM were EUR 12 million. Initially targeted synergies of EUR 10 million will be exceeded. With a deeper understanding of the DBM organisation, more cost savings have been identified mainly related to additional branch network optimisation potential. Total synergies of EUR 20 million are now targeted and are expected to be fully realised by the end of 2012. For Q1 2012, integration costs are expected to amount to approximately EUR 3 million.

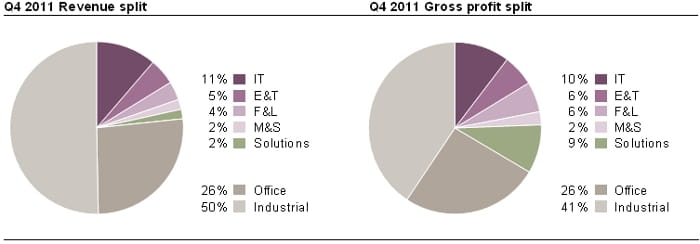

BUSINESS LINE PERFORMANCE

Adecco’s revenues in the General Staffing business (Office & Industrial) increased by 3% in constant currency to EUR 4 billion. Revenues in the Industrial business were up 2% in constant currency. Revenue growth in Germany & Austria remained strong, up 15% year-on-year. In France revenues were flat in Q4 2011 and Italy slowed to 4%, after several quarters of strong double-digit revenue growth. Revenues in North America declined by 6% in constant currency. In the Office business, revenues increased 5% in constant currency. In Japan revenues were up 5% and in North America revenues increased by 12%, both in constant currency. In the UK & Ireland revenues were down 2% and in the Nordics down 9%, both in constant currency. Revenues in France declined by 8%.

The Professional Staffing 4 revenues increased 4% in constant currency. Germany & Austria and France continued to deliver double-digit revenue growth. Also, UK & Ireland grew double-digit in constant currency in Q4 2011, mainly driven by good developments in IT. Revenues in North America declined by 2% in constant currency.

In Information Technology (IT), revenues increased 8% in constant currency. In North America, revenues declined by 8% in constant currency. On the other hand, revenues in the UK & Ireland developed strongly, increasing double-digit in constant currency, driven by a few larger project wins.

Adecco’s Engineering & Technical (E&T) business was up 2% in constant currency. Growth continued to be solid in Germany & Austria and France with revenues up 11% and 18% respectively. In North America, revenues declined by 1% year-on-year, compared to a very strong fourth quarter last year, where revenues increased by 36% organically.

In Finance & Legal (F&L), revenues were down 1% in constant currency. Revenues in North America increased by 5%, while business in the UK & Ireland remained difficult, resulting in a revenue decline in Q4 2011 of 11%, all in constant currency.

In Q4 2011, revenues in Medical & Science (M&S) were flat in constant currency.

In the quarter under review, revenues in Solutions 5 were up 25% in constant currency and up 1% organically, mainly still impacted by the counter-cyclical career transition (outplacement) business.

MANAGEMENT OUTLOOK

Year-on-year revenue growth continued to soften during Q4 2011, albeit compared against a strong fourth quarter in 2010. In January 2012, Adecco Group revenues were down 1% compared to the prior year, on an organic basis and adjusted for trading days. Within Europe, revenue growth in Germany & Austria remained double-digit in January 2012. Most other countries slowed further going into the new year. In North America, revenues were up slightly year-on-year in January 2012, adjusted for trading days, while revenue growth in the Emerging markets continued to be healthy.

The Adecco Group is solidly positioned for the future. In an environment of economic uncertainty we will continue to build on our strengths – our leading global position and the diversity of our service offerings. We will continue to take advantage of growth opportunities, with a strong focus on disciplined pricing and cost control to optimise profitability and value creation. Besides the structural changes and related investments of EUR 45 million in France, which would mainly be incurred in the second half of 2012, management expects additional costs of EUR 10 million in the first half of 2012, to further optimise the cost base in other European countries and to protect profitability. We are committed to our strategic priorities and we have the right offering to achieve our EBITA margin target of above 5.5% mid-term.

Recent CHF 350 million bond issuance

On February 8, 2012, Adecco S.A. placed a 4-year CHF 350 million bond with a coupon of 2.125%. The notes were issued within the framework of the Euro Medium Term Note Programme and are traded on the SIX Swiss Exchange. The proceeds are for general corporate purposes.

PROPOSALS TO SHAREHOLDERS

Dividend payout

Given Adecco’s solid financial position and strong cash flow generation, it was decided to increase the pay-out range from the Group’s traditional payout range of 25-30% to 40-50% of adjusted net earnings. This range is seen as sustainable going forward. At the Annual General Meeting, the Board of Directors will propose a dividend of CHF 1.80 per share for 2011, for approval by shareholders. This represents an increase of 64%, compared to the dividend paid for 2010 and is equivalent to a payout ratio of 45% based on adjusted net earnings. The total amount of the dividend distribution for 2011 is intended to be paid out of the capital contribution reserve, and is therefore exempt from Swiss withholding tax. The dividend payment to shareholders is planned on May 8, 2012.

Changes to the Board of Directors

The Board of Directors proposes Dominique-Jean Chertier to be elected as a new member of the Board of Directors for tenure of one year ending at the next Annual General Shareholders’ Meeting. Dominique-Jean Chertier (1950) is a French national. He obtained a doctorate degree from Sorbonne University, France. Since 2011 he has been Deputy CEO of Safran Group (France), an international high-technology group with three core businesses: aerospace, defence and security. Dominique-Jean Chertier had been Executive Vice-president of Safran Group from 2003 to 2011. From 2002 to 2003 he was Social Advisor to the French Prime Minister. From 1992 to 2002, he held the position of Chief Executive Officer at Unedic (French unemployment insurance). Dominique-Jean Chertier has been a member of the Board of Directors of Air France since 2004 and he was Chairman of POLE EMPLOI (French employment and unemployment national agency) from 2008 to 2011.

For further information please contact:

Adecco Corporate Investor Relations

Investor.relations@adecco.com or +41 (0) 44 878 89 89

Adecco Corporate Press Office

Press.office@adecco.com or +41 (0) 44 878 87 87

Q4/FY 2011 Results Conference Calls

There will be a media conference call at 9 am CET as well as an analyst conference call at 11 am CET, details of which can be found on our website in the Investor Relations section at http://webcast.adecco.com

|

UK / Global |

+ 44 (0)203 059 58 62 |

|

United States |

+ 1 866 291 41 66 |

|

Cont. Europe |

+ 41 (0)91 610 56 00 |

Financial Agenda 2012

|

April 24, 2012 |

|

May 3, 2012 |

|

May 8, 2012 |

|

May 8, 2012 |

|

August 9, 2012 |

|

November 6, 2012 |

Forward-looking statements

Information in this release may involve guidance, expectations, beliefs, plans, intentions or strategies regarding the future. These forward-looking statements involve risks and uncertainties. All forward-looking statements included in this release are based on information available to Adecco S.A. as of the date of this release, and we assume no duty to update any such forward-looking statements. The forward-looking statements in this release are not guarantees of future performance and actual results could differ materially from our current expectations. Numerous factors could cause or contribute to such differences. Factors that could affect the Company’s forward-looking statements include, among other things: global GDP trends and the demand for temporary work; changes in regulation of temporary work; intense competition in the markets in which the Company operates; integration of acquired companies; changes in the Company’s ability to attract and retain qualified internal and external personnel or clients; the potential impact of disruptions related to IT; any adverse developments in existing commercial relationships, disputes or legal and tax proceedings.

NOTES

-

Organic growth is a non US GAAP measure and excludes the impact of currency and acquisitions.

-

EBITA is a non US GAAP measure and refers to operating income before amortisation of intangible assets.

-

Net debt is a non US GAAP measure and comprises short-term and long-term debt less cash and cash equivalents and short-term investments.

-

Professional Staffing refers to Adecco’s Information Technology, Engineering & Technical, Finance & Legal, and Medical & Science businesses.

-

Solutions include revenues from Human Capital Solutions, Managed Service Programmes (MSP), Recruitment Process Outsourcing (RPO) and Vendor Management System (VMS).