First quarter 2014 highlights

-

Revenues up 6% year-on-year in constant currency

-

Gross margin 18.6%, up 60 bps

-

SG&A excluding restructuring costs [1] up 3% in constant currency

-

EBITA [2] excluding restructuring costs EUR 185 million, up 41% in constant currency

-

EBITA margin excluding restructuring costs 4.0%, up 100 bps

-

Net income attributable to Adecco shareholders up 64%, basic EPS up 69%

Key figures Q1 2014

|

in EUR millions |

Q1 2014 |

Reported |

Constant currency growth |

|---|---|---|---|

|

Revenues |

4,656 |

2% |

6% |

|

Gross profit |

868 |

6% |

10% |

|

EBITA excluding restructuring costs |

185 |

35% |

41% |

|

EBITA |

180 |

42% |

49% |

|

Operating income |

171 |

47% |

54% |

|

Net income attributable to Adecco shareholders |

110 |

64% |

- |

The Adecco Group, the world’s leading provider of Human Resources solutions, today announced results for Q1 2014. Revenues were EUR 4.7 billion, up 6% in constant currency. The gross margin was 18.6%, an increase of 60 bps versus the prior year. SG&A excluding restructuring costs was up 3% in constant currency. The EBITA margin excluding restructuring costs was 4.0%, up 100 bps compared to the same quarter last year. Net income attributable to Adecco shareholders was up 64% to EUR 110 million and basic EPS increased by 69% to EUR 0.62.

Patrick De Maeseneire, CEO of the Adecco Group said:

“In the first quarter our more than 31,000 colleagues delivered another strong performance. Revenue growth continued to pick up in Europe, led once again by our Industrial business. Demand in manufacturing accelerated further, which is a good early-cycle indicator. We achieved double-digit constant currency growth in Iberia, Italy, Germany & Austria, Benelux, the Nordics and Eastern Europe, showing that the European economic recovery is slowly strengthening and broadening. During the first four months of the year, the Group as a whole has seen a trend of gradual improvement: revenue growth was 5% for January and February combined and 6% for March and April combined, in constant currency and adjusted for trading days. We continue to be very focused on reaching our EBITA margin target of above 5.5% in 2015. Based on the good progress on our six strategic priorities, recent trends and continued favourable economic conditions expected going forward, we remain convinced we will achieve this target.”

Q1 2014 FINANCIAL PERFORMANCE

Revenues

Q1 2014 revenues of EUR 4.7 billion were up 2% year-on-year, or up 6% in constant currency. Currency fluctuations had a negative impact on revenues of approximately 4% and there was no material impact from acquisitions and divestitures. Permanent placement revenues amounted to EUR 81 million, up 5% in constant currency. Revenues from Career Transition (outplacement) totalled EUR 77 million, up 13% in constant currency.

Gross Profit

Gross profit amounted to EUR 868 million, an increase of 6% or 10% in constant currency. The gross margin was 18.6%, up 60 bps year-on-year. Temporary staffing had a 60 bps positive impact on gross margin, driven by our continued strict approach to pricing as well as the effect of the French CICE (tax credit for competitiveness and employment). The outplacement business added a further 10 bps to gross margin, permanent placement had a neutral effect and other activities had a negative impact of 10 bps.

Selling, General and Administrative Expenses (SG&A)

SG&A was EUR 688 million, down 1% compared to Q1 2013. Restructuring costs were EUR 5 million, compared to EUR 11 million in Q1 2013. SG&A excluding restructuring costs was up 3% in constant currency to EUR 683 million. Sequentially, SG&A excluding restructuring costs was up 2% in constant currency. FTE employees decreased by 1% to 31,400 and the branch network decreased by 4% to 5,040 compared to Q1 2013.

EBITA

EBITA was EUR 180 million. EBITA excluding restructuring costs was EUR 185 million, up 41% in constant currency compared to the prior year. The EBITA margin excluding restructuring costs was 4.0%, up 100 bps compared to 3.0% in Q1 2013.

Amortisation of Intangible Assets

Amortisation of intangible assets was EUR 9 million compared to EUR 11 million in Q1 2013.

Operating Income

Operating income was EUR 171 million compared to EUR 116 million last year.

Interest Expense and Other Income/(Expenses), net

Interest expense was EUR 20 million compared to EUR 19 million in Q1 2013. Other income/(expenses) net, was an income of EUR 1 million in Q1 2014 compared to an expense of EUR 2 million in Q1 2013.

Provision for Income Taxes

The effective tax rate was 27% compared to 29% in the prior year.

Net Income Attributable to Adecco Shareholders and EPS

Net income attributable to Adecco shareholders was EUR 110 million compared to EUR 67 million last year. Basic EPS increased to EUR 0.62 from EUR 0.37.

Cash flow, Net Debt [3] and DSO

Cash flow generated from operating activities was EUR 103 million in Q1 2014 compared to cash used in operating activities of EUR 28 million in the same period last year. The Group invested EUR 17 million in capex and paid EUR 30 million for treasury shares. Net debt at the end of March 2014 was EUR 1,028 million compared to EUR 1,096 million at year end 2013. DSO was 53 days in Q1 2014, one day less than in Q1 2013.

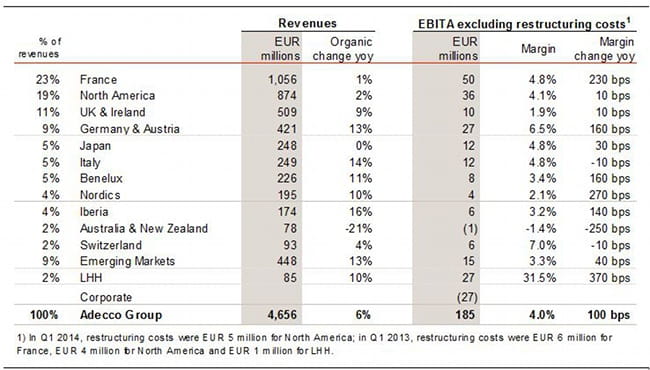

Q1 2014 SEGMENT PERFORMANCE

Note: all revenue growth rates in this section are year-on-year on an organic [4] basis, unless otherwise stated

In France, revenues of EUR 1.1 billion were up 1%. The return to growth was driven by an increase of 3% in Industrial, which accounts for approximately 85% of revenues in France. In Office, revenues decreased by 16%, while in Professional Staffing the decline was 3%. Permanent placement revenues in France returned to growth and were up 4%. EBITA was EUR 50 million and the EBITA margin was 4.8%. This is a 230 bps increase compared to the EBITA margin excluding restructuring costs of 2.5% in Q1 2013. This quarter CICE (tax credit for competitiveness and employment) had a further positive effect year-on-year, due to the increase in the rate of the credit from December 1, 2013 and the reassessment we made in Q3 2013 of CICE relating to prior periods and going forward.

In North America, revenues were EUR 874 million. This is an increase of 2%, held back by adverse weather conditions in January and February 2014. In North America, General Staffing accounts for approximately half of revenues, split roughly evenly between Industrial and Office. In Industrial, revenue growth remained strong at 9%. In Office, revenues declined by 5%, driven by continued weak demand from clients in Financial Services. Revenues in Professional Staffing grew by 2%, driven by steady growth of 5% in IT. Revenues in Finance & Legal were up 1%, with good growth in Finance offset by a decline in Legal, which benefited from a large contract in the prior year that did not recur. Engineering & Technical was flat and Medical & Science saw a decline of 3%. Permanent placement revenues in North America were up 11%. EBITA was EUR 31 million, which includes restructuring costs of EUR 5 million related to the move to a single headquarters in North America. EBITA excluding restructuring costs was EUR 36 million, with the margin increasing by 10 bps to 4.1%.

In the UK & Ireland, revenues increased by 9% to EUR 509 million. Approximately two-thirds of revenues come from Professional Staffing, which grew by 13%. This included revenue growth of 17% in IT and 4% in Finance & Legal, partly offset by a 10% decline in Engineering & Technical. Within General Staffing, the majority of revenues are in Office, which saw a flat revenue development. Permanent placement revenues in the UK & Ireland were flat. EBITA was EUR 10 million with a margin of 1.9% compared to 1.8% in Q1 2013.

In Germany & Austria, revenues were EUR 421 million, up 13%. Growth was driven by Industrial, which accounts for approximately 70% of revenues and which grew by 19% in Q1 2014 after growth of 14% in Q4 2013. Demand from clients in the automotive and equipment manufacturing sectors continued to be good. Revenues in Professional Staffing fell 3%, driven by a decline of 3% in Engineering & Technical. EBITA was EUR 27 million, with a margin of 6.5% compared to 4.9% in Q1 2013. This increase was partly due to the timing of bank holidays, with Easter Friday falling in March last year and in April this year.

In Japan, revenues were EUR 248 million, in-line with Q1 2013. Revenues declined by 4% in Office, which accounts for approximately 75% of our revenues in Japan. This was offset by strong revenue growth of 10% in our smaller Professional Staffing business, which comprises IT and Engineering & Technical. Despite the flat revenues, profitability was again strong. EBITA was EUR 12 million and the EBITA margin was 4.8% compared to 4.5% in the prior year.

In Italy, revenues were up 14%, helped by good demand from manufacturing clients. Profitability continued to be robust with an EBITA margin of 4.8%. In Benelux, revenues increased by 11%, with especially strong performances in the Netherlands and Luxembourg. The EBITA margin strengthened to 3.4%, up 160 bps year-on-year.

In the Nordics, revenues were up 10%. In Norway the environment remains challenging, but Sweden returned to good growth after two years of difficult market conditions. Revenue growth continued to be strong in Denmark. In the Nordics the EBITA margin improved to 2.1% compared to -0.6% in the prior year. In Iberia, revenues were up 16%, driven by further strengthening demand from export-oriented clients. The EBITA margin was 3.2%, up 140 bps year-on-year due to strong operating leverage.

In Australia & New Zealand, revenues fell by 21%, negatively impacted by client losses in the second half of 2013. This resulted in significant deleveraging and weak profitability. In Switzerland, revenues returned to growth and were up 4%. Profitability continued to be strong, with an EBITA margin of 7.0%.

In the Emerging Markets, revenue growth was 13%, with the excellent growth in Eastern Europe & MENA further accelerating to 30%. The EBITA margin for Emerging Markets was 3.3%, up 40 bps year-on-year.

Revenues of LHH, Adecco’s Career Transition and Talent Development business, were up 10%. This included double-digit growth in both North America and France, which account for approximately 50% and 25% of LHH revenues, respectively. The EBITA margin for LHH was strong at 31.5%.

MANAGEMENT OUTLOOK

In the first quarter we saw a continuation of the positive momentum with which we ended last year. Revenue growth continued to pick up in Europe, led once again by our Industrial business. Demand in manufacturing accelerated further, which is a good early-cycle indicator. We achieved double-digit constant currency growth across most of our regions in Europe, showing that the European economic recovery is slowly strengthening and broadening.

During the first four months of the year, the Group as a whole has seen a trend of gradual improvement: revenue growth was 5% for January and February combined and 6% for March and April combined, in constant currency and adjusted for trading days. Based on the current economic outlook and the trends we see within our business, we expect demand for flexible labour to increase further over the course of 2014.

Given these trends, we will continue to invest selectively where we see organic growth opportunities and where productivity is already at a high level, whilst maintaining our overall focus on tight cost control. SG&A in Q2 2014 is expected to be at a similar level to Q1 2014 on a constant currency basis and excluding restructuring costs.

We continue to be very focused on reaching our EBITA margin target of above 5.5% in 2015. Based on the good progress on our six strategic priorities, recent trends and continued favourable economic conditions expected going forward, we remain convinced we will achieve this target.

SHARE BUYBACK PROGRAMME

In September 2013, the Company launched a share buyback programme of up to EUR 250 million on a second trading line with the aim of subsequently cancelling the shares and reducing the share capital. To date, the Company has acquired 1.2 million shares under this programme for EUR 70 million.

Q1 2014 Results Conference Calls

There will be a media conference call at 9 am CET as well as an analyst conference call at 11 am CET. The conferences can be followed either via webcast (media conference, analyst conference) or via telephone call:

|

UK / Global |

+ 44 (0)203 059 58 62 |

|

United States |

+ 1 (1)631 570 56 13 |

|

Cont. Europe |

+ 41 (0)58 310 50 00 |

The Q1 2014 results presentation will be available through the webcasts and will be published in the Investor Relations section on our website .

Financial Agenda

|

• Q2/HY 2014 results • Investor Days • Q3 2014 results |

August 7, 2014 September 24/25, 2014 November 6, 2014 |

Forward-looking statements

Information in this release may involve guidance, expectations, beliefs, plans, intentions or strategies regarding the future. These forward-looking statements involve risks and uncertainties. All forward-looking statements included in this release are based on information available to Adecco S.A. as of the date of this release, and we assume no duty to update any such forward-looking statements. The forward-looking statements in this release are not guarantees of future performance and actual results could differ materially from our current expectations. Numerous factors could cause or contribute to such differences. Factors that could affect the Company’s forward-looking statements include, among other things: global GDP trends and the demand for temporary work; changes in regulation of temporary work; intense competition in the markets in which the Company operates; integration of acquired companies; changes in the Company’s ability to attract and retain qualified internal and external personnel or clients; the potential impact of disruptions related to IT; any adverse developments in existing commercial relationships, disputes or legal and tax proceedings.