-

Revenues up 4% year-on-year in constant currency

-

Gross margin 18.4%, up 10 bps under lying [1]

-

SG&A excluding restructuring costs [2] up 2% yoy and down 2% sequentially, both in constant currency

-

EBITA [3] excluding restructuring costs EUR 280 million

-

EBITA margin excluding restructuring costs 5.4%, up 40 bps underlying

-

Net income attributable to Adecco shareholders up 4%, basic EPS up 6%

|

in EUR millions |

Q3 2014 |

Reported |

Underlying constant currency growth |

|---|---|---|---|

|

Revenues |

5,185 |

3% |

4% |

|

Gross profit |

954 |

1% |

5% |

|

EBITA excluding restructuring costs |

280 |

1% |

13% |

|

EBITA |

275 |

1% |

12% |

|

Operating income |

266 |

1% |

|

|

Net income attributable to Adecco shareholders |

198 |

4% |

The Adecco Group, the world’s leading provider of Human Resources solutions, today announced results for Q3 2014. Revenues were EUR 5.2 billion, up 4% in constant currency. The gross margin was 18.4%, up 10 bps underlying. SG&A excluding restructuring costs was up 2% yoy and down 2% sequentially, both in constant currency. The EBITA margin excluding restructuring costs was 5.4%, up 40 bps underlying compared to the same quarter last year. Net income attributable to Adecco shareholders was up 4% to EUR 198 million and basic EPS increased by 6% to EUR 1.13.

Patrick De Maeseneire, CEO of the Adecco Group said:

“In the third quarter our colleagues delivered another good performance. Revenue growth slowed compared to the first half, mainly driven by weaker growth in France and Germany. In North America we saw a pick-up in activity as expected, and Emerging Market growth remained robust. The Group exited the quarter with revenue growth of 2% in September, organically and adjusted for trading days. Our EBITA margin development in Q3 2014 was again encouraging, an underlying improvement of 40 bps compared to last year. We continue to be very focused on reaching our EBITA margin target of above 5.5% in 2015. Despite the recent softening of the economic environment, a pick-up of GDP growth is expected for next year. Given this outlook and based on the good progress on our six strategic priorities and our continued price and cost discipline, we remain convinced we will achieve our target.”

Q3 2014 FINANCIAL PERFORMANCE

Revenues

Q3 2014 revenues of EUR 5.2 billion were up 3% year-on-year, or up 4% in constant currency and up 3.5% organica lly [4] . Currency fluctuations had a negative impact on revenues of approximately 1%. By business line, constant currency growth was 4% in General Staffing, with Industrial up 6% and Office up 1%, and 1% in Professional Staffing. Permanent placement revenues were EUR 91 million, up 15% in constant currency. Revenues from Career Transition (outplacement) totalled EUR 69 million, up 5% in constant currency.

Gross Profit

Gross profit amounted to EUR 954 million and the gross margin was 18.4%, down 30 bps year-on-year. Last year, the reassessment of the French CICE resulted in a 50 bps benefit to the temporary staffing gross margin in Q3 2013 relating to prior periods. Excluding this benefit, Q3 2014 gross margin increased by 10 bps year-on-year and temporary staffing had a 10 bps positive impact on gross margin. Permanent placement had a 20 bps positive impact and the outplacement business had a neutral effect, while other activities had a 20 bps negative impact.

Selling, General and Administrative Expenses (SG&A)

SG&A was EUR 679 million, up 2% compared to Q3 2013. Restructuring costs were EUR 5 million, compared to EUR 3 million in Q3 2013. SG&A excluding restructuring costs was EUR 674 million, up 2% year-on-year in constant currency. Sequentially, SG&A excluding restructuring costs was down 2% in constant currency. Compared to Q3 2013, FTE employees increased by 2% and the branch network decreased by 1%.

EBITA

EBITA was EUR 275 million and EBITA excluding restructuring costs was EUR 280 million. The EBITA margin excluding restructuring costs was down 10 bps to 5.4%. Last year, the reassessment of the French CICE resulted in a 50 bps benefit to the EBITA margin in Q3 2013 relating to prior periods. Excluding this benefit, Q3 2014 EBITA margin excluding restructuring costs increased by 40 bps year-on-year.

Amortisation of Intangible Assets

Amortisation of intangible assets was EUR 9 million compared to EUR 10 million in Q3 2013.

Operating Income

Operating income was EUR 266 million compared to EUR 263 million in the same period last year.

Interest Expense and Other Income/(Expenses), net

Interest expense was EUR 15 million compared to EUR 20 million in Q3 2013. Other income/(expenses) net, was an income of EUR 3 million in Q3 2014 compared to an income of EUR 1 million in Q3 2013.

Provision for Income Taxes

The effective tax rate was 22%, the same as in the prior year. In both years, the tax rate was positively impacted by the successful resolution of prior years’ audits and tax disputes and the expiration of the statute of limitations in several jurisdictions.

Net Income Attributable to Adecco Shareholders and EPS

Net income attributable to Adecco shareholders was EUR 198 million compared to EUR 190 million last year. Basic EPS increased to EUR 1.13 from EUR 1.06.

Cash flow, Net Debt [5] and DSO

Cash flow generated from operating activities was EUR 268 million in Q3 2014 compared to EUR 281 million in the same period last year. In Q3 2014, capex was EUR 20 million and the group paid EUR 118 million for treasury shares. Net debt at September 30, 2014 was EUR 1,149 million compared to EUR 1,262 million at June 30, 2014. DSO was 54 days in Q3 2014, the same as in Q3 2013.

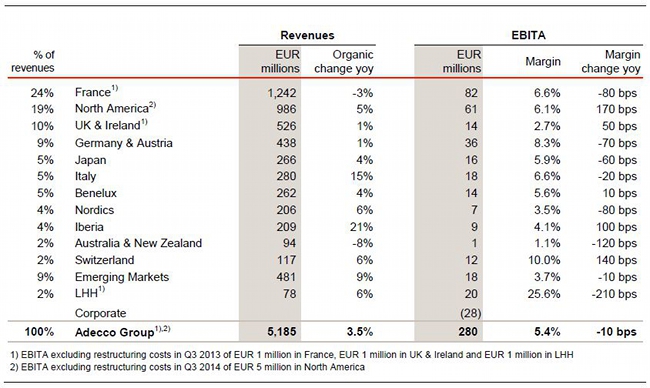

Q3 2014 SEGMENT PERFORMANCE

Note: all growth rates in this section are year-on-year on an organic basis, unless otherwise stated

In France, revenues were EUR 1.2 billion, a decrease of 3%. Industrial, which accounts for approximately 85% of revenues, decreased by 1%. In Office, revenues decreased by 19%, while in Professional Staffing the decline was 3%. Permanent placement revenues in France were up 15%. EBITA was EUR 82 million and the EBITA margin was 6.6%. This is an 80 bps decrease compared to the EBITA margin excluding restructuring costs of 7.4% in Q3 2013, which was favourably impacted by 190 bps due to the reassessment of CICE relating to prior periods. Excluding this effect, in Q3 2013 the EBITA margin excluding restructuring costs was 5.5% and the year-on-year increase in Q3 2014 was 110 bps.

In North America, revenues were EUR 986 million, an increase of 5%. In North America, General Staffing accounts for approximately half of revenues. In Industrial, revenue growth was strong at 12%, while in Office, revenues grew by 1%. Revenues in Professional Staffing grew by 3%, with growth of 2% in IT, 1% Engineering & Technical, 5% in Finance & Legal and 15% in Medical & Science. Permanent placement revenues in North America were up 10%. EBITA was EUR 56 million, which includes restructuring costs of EUR 5 million related to the move to a single headquarters in North America. EBITA excluding restructuring costs was EUR 61 million, with the margin increasing strongly to 6.1%. Note that Q3 2013 included an asset writedown, which negatively impacted the EBITA margin by 30 bps.

In the UK & Ireland, revenues increased by 1% to EUR 526 million. Approximately two-thirds of revenues come from Professional Staffing, which grew by 2%. This included revenue growth of 3% in IT. Within General Staffing, the majority of revenues are in Office, which declined by 1%. Permanent placement revenues in the UK & Ireland increased by 9%. Overall, UK & Ireland gross profit growth was 4%. EBITA was EUR 14 million with a margin of 2.7% compared to the EBITA margin excluding restructuring costs of 2.2% in Q3 2013.

In Germany & Austria, revenues grew by 1% to EUR 438 million. In Industrial, which accounts for approximately 70% of revenues, revenue growth was 2% compared to 11% in Q2 2014. This reflects weaker demand from clients in the automotive and equipment manufacturing sectors. Revenues declined in Office by 6% and in Professional Staffing by 1%. EBITA was EUR 36 million, with a margin of 8.3% compared to 9.0% in Q3 2013.

In Japan, revenues were EUR 266 million, up 4%. Revenues grew by 2% in Office, which accounts for approximately 75% of our revenues in Japan. Our smaller Professional Staffing business, which comprises IT and Engineering & Technical continued to grow solidly. EBITA was EUR 16 million and the EBITA margin was 5.9% compared to 6.5% in the prior year.

In Italy, revenues were up 15%, helped by good demand from manufacturing clients. Profitability continued to be strong with an EBITA margin of 6.6%.

In Benelux, revenues increased by 4% and the EBITA margin improved to 5.6%, up 10 bps year-on-year.

In the Nordics, revenues were up 6%. In Norway and Sweden the environment remains challenging, whilst growth continued to be strong in Denmark. In the Nordics the EBITA margin declined by 80 bps to 3.5%.

In Iberia, revenues were up 21%, driven by further strong demand from export-oriented clients. The EBITA margin was 4.1%, up 100 bps year-on-year due to strong operating leverage.

In Australia & New Zealand, revenues fell by 8%, still negatively impacted by client losses in the second half of 2013. Profitability improved compared to H1 2014, but the EBITA margin in Q3 2014 remained below the prior year.

In Switzerland, revenues were up 6% compared to Q3 2013. Profitability was strong, with the EBITA margin increasing by 140 bps to 10.0%.

In the Emerging Markets, revenue growth was 9%, with continued strong growth in Eastern Europe & MENA, up 17%. The EBITA margin for Emerging Markets was 3.7% compared to 3.8% in Q3 2013.

In LHH, Adecco’s Career Transition and Talent Development business, revenue growth was 6%. The EBITA margin remained strong at 25.6%.

MANAGEMENT OUTLOOK

In the third quarter, organic revenue growth slowed compared to the first half, mainly driven by weaker growth in France and Germany. The Group exited Q3 2014 with revenue growth of 2% in September and saw similar growth in October, organically and adjusted for trading days. This reflects some uncertainty in parts of Europe, consistent with the recent softer economic data. By contrast, activity is improving in North America and we see a more broad-based pickup in our business there. In Emerging Markets, growth remains robust. Based on these trends and the current economic outlook, we expect demand for flexible labour to improve again over the course of 2015.

Given this picture, we will continue to invest selectively where we see organic growth opportunities and where productivity is already at a high level. At the same time, we maintain our focus on tight cost control. In response to recent market developments, we will spend EUR 15 million in Q4 2014 to further structurally improve our profitability in certain key markets such as Germany. This is in addition to the remaining EUR 5 million of planned spend for headquarters consolidation in North America, as previously indicated. In Q4 2014, SG&A is expected to increase slightly compared to Q3 2014 on an organic basis and excluding restructuring costs, in-line with the normal seasonal pattern.

We continue to be very focused on reaching our EBITA margin target of above 5.5% in 2015. Despite the recent softening of the economic environment, a pick-up of GDP growth is expected for next year. Given this outlook and based on the good progress on our six strategic priorities and our continued price and cost discipline, we remain convinced we will achieve our target.

SHARE BUYBACK PROGRAMME

In September 2013, the Company launched a share buyback programme of up to EUR 250 million on a second trading line with the aim of subsequently cancelling the shares and reducing the share capital. To date, the Company has acquired 4.3 million shares under this programme for EUR 239 million. After completion of the current programme, the Company intends to launch a new share buyback programme of up to EUR 250 million. The new programme will also be executed on a second trading line with the SIX Swiss Exchange with the aim of subsequent cancellation of the shares and reduction of the share capital, after formal shareholder approval.

For further information please contact:

Adecco Corporate Investor Relations

Investor.relations@adecco.com or +41 (0) 44 878 89 89

Adecco Corporate Press Office

Press.office@adecco.com or +41 (0) 44 878 87 87

Q3 2014 Results Conference Calls

There will be a media conference call at 9 am CET as well as an analyst conference call at 11 am CET. The conferences can be followed either via webcast (media conference, analyst conference) or via telephone call:

|

UK / Global |

+ 44 (0)203 059 58 62 |

|

United States |

+ 1 (1)631 570 56 13 |

|

Cont. Europe |

+ 41 (0)58 310 50 00 |

The Q3 2014 results presentation will be available through the webcasts and will be published in the Investor Relations section on our website .

Financial Agenda

|

• Q4 2014 results |

March 11, 2015 |

|

• Annual General Meeting |

April 21, 2015 |

|

• Q1 2015 results |

May 7, 2015 |

|

• Q2 2015 results |

August 11, 2015 |

|

• Q3 2015 results |

November 5, 2015 |

Notes

[1] In Q3 2013, the reassessment of the French CICE resulted in a benefit relating to prior periods of 50 bps on the temporary staffing gross margin and on the EBITA margin of the Adecco Group. ‘Underlying’ refers to the Q3 2014 year-on-year change excluding this effect.

[2] Restructuring costs were EUR 5 million in Q3 2014 and EUR 3 million in Q3 2013.

[3] EBITA is a non-US GAAP measure and refers to operating income before amortisation of intangible assets.

[4] Organic growth is a non-US GAAP measure and excludes the impact of currency, acquisitions and divestitures.

[5] Net debt is a non-US GAAP measure and comprises short-term and long-term debt less cash and cash equivalents and short-term investments.

Forward-looking statements

Information in this release may involve guidance, expectations, beliefs, plans, intentions or strategies regarding the future. These forward-looking statements involve risks and uncertainties. All forward-looking statements included in this release are based on information available to Adecco S.A. as of the date of this release, and we assume no duty to update any such forward-looking statements. The forward-looking statements in this release are not guarantees of future performance and actual results could differ materially from our current expectations. Numerous factors could cause or contribute to such differences. Factors that could affect the Company’s forward-looking statements include, among other things: global GDP trends and the demand for temporary work; changes in regulation affecting temporary work; intense competition in the markets in which the Company operates; integration of acquired companies; changes in the Company’s ability to attract and retain qualified internal and external personnel or clients; the potential impact of disruptions related to IT; any adverse developments in existing commercial relationships, disputes or legal and tax proceedings.