Over 500 leaders from government, business and civil society convened at the World Economic Forum (WEF) Jobs Reset Summit 2021 this month to set out a new agenda for growth, jobs, skills and equity, and lay the foundations of a new economy, one that provides opportunities for all.

Last year the pandemic cost the global workforce an equivalent of 255 million full-time jobs, an estimated $3.7 trillion in wages and 4.4% of global GDP, with a devastating impact on lives and livelihoods. The outlook for economic growth and the global recovery of jobs is predicted to improve, but it is far from certain. Here are the key takeaways from the summit.

Understanding the Global Economic Outlook

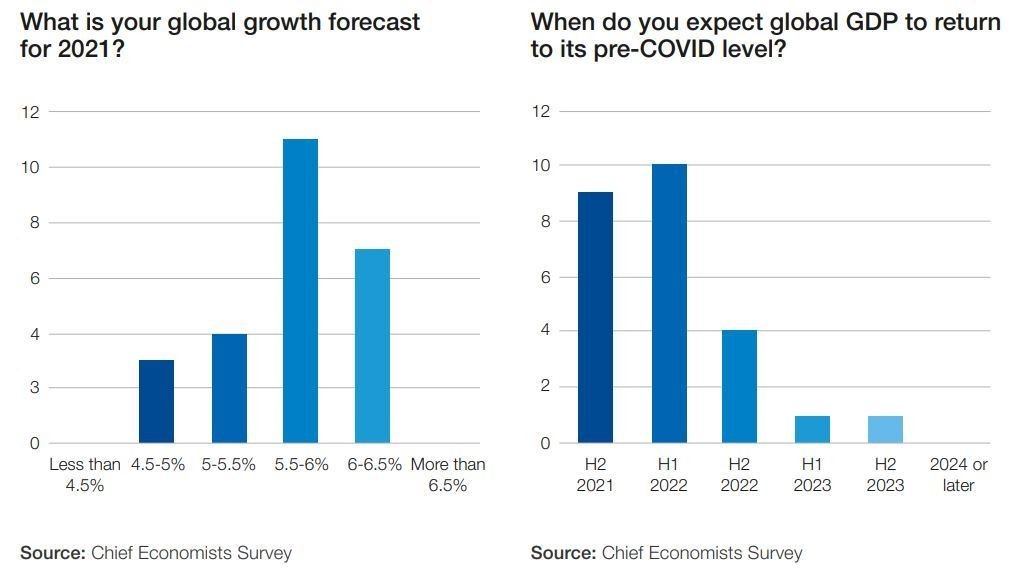

The global economic outlook has a long road ahead, chief economists said during the Jobs Reset Summit this week. Panelists at the forum, in addition to respondents to the Chief Economists Survey, predicted a growth rate of around 6% for 2021. The global GDP should return to pre-pandemic levels by 2022, experts predicted, but the recovery will vary dramatically between emerging economies and advanced economies.

Predictions of a year-on-year improvement in growth across the board were tempered by warnings of longer-term concerns in terms of how the recovery will play out globally.

“The key question is how well-equipped the developing world is to deal with a faster recovery trajectory of the developed world,” said Razia Khan, chief economist Africa and Middle East at Standard Chartered Bank.

Rising inflation is another cause for concern, and respondents to the Chief Economists Survey expect monetary authorities to hold steady on prioritizing price stability, implying an increase in rates in the not too distant future as inflation is starting to pick up.

Questions were raised over the prospects of a cliff edge in Q3. Ludovic Subran, chief economist at Allianz SE, said: “For policymakers, the fall could be a time when purchasing power and wage policy is going to be flashing red lights for social cohesion and unrest.”

The withdrawal of stimulus and support packages in the US and UK could see companies that retained staff because of those support packages ultimately let those staff go, causing a spike in unemployment and longer-term scarring for labour markets. Khan is more optimistic.

“Should we expect a cliff edge?” Khan said. “No, policy is not going to allow that to happen. The real question, is what are the unintended consequences for everyone else?”

According to Nikhil Madgavkar, chief risk officer at Mahindra Group, the biggest uncertainty would be around the health, social, climate, economic and digital spheres.

“Companies that don’t listen to stakeholders and address today’s social, health and environmental challenges will fall aside,” he said.

Accelerating the Reskilling Revolution

In 2020, the global workforce lost the equivalent of 255 million full-time jobs. The pandemic, combined with the effects on technology, are reducing the shelf life of skills.

An accelerated investment towards reskilling and upskilling of workers could inject at least $6.5 trillion to the global GDP by 2030 and may create 5.3 million (net) new jobs. It would also help develop more inclusive and sustainable economies and societies worldwide.

Alain Dehaze, CEO of the Adecco Group participated in one of the closed sessions during the Summit and advocated for the need to focus on re- and upskilling.

“The Reskilling Revolution must reach beyond the economic support measures to companies and workers that we saw in the early days of the crisis. It requires a multi-stakeholder solution”, Dehaze said.

Investing in skills requires a multi-stakeholder solution. First, we need to invest in the worker to promote a mindset of Lifelong Learning. Second, companies should shift from the idea that the workforce is replaceable to renewable, by breaking the cycle of hiring/firing and rather invest in the existing workforce. Finally, Governments should incentivize re- and upskilling by partnering with private sector experts.

“Companies must shift from a replaceable to a renewable workforce, breaking the cycle of laying-off and hiring in order to tackle the skills shortage.” He also pointed out that governments play a crucial role providing the framework placing the incentives in the right place: either by introducing individual learning accounts, providing tax incentives to businesses that re- and upskill or put in place training funds."

Planning for a Global Jobs Recovery

How can countries pivot attention and investment into the emerging, high-quality jobs of tomorrow with the most potential to create mass employment and opportunity?

On day two of the Jobs Reset Summit, a panel of speakers discussed the impact of the pandemic on jobs, the role that technology is playing in reshaping the global workforce, and the skills that will needed along the way.

Guy Ryder, Director-General of the ILO, believes that technology has played a major role in getting through the pandemic, enabling people to continue to work and companies to continue to function. He said it had accelerated changes to working styles that were already on the way, and offered choice and news ways of working that could be beneficial in solving some of the current labour market challenges. Yet, the problem of connectivity has been raised, as many places are still not connected.

A lasting negative impact of the pandemic? Progress relating to equality in the economy. Around 150 million new tech-enabled jobs are expected to be created over the next five years. Those jobs are in demand and highly paid, but LinkedIn founder Allen Blue fears that some groups are likely to miss out on these new opportunities. “Firstly, women lost one or two years of progress in terms of their ability to participate fully in workforce, and secondly, the pandemic is receding unevenly around the world, with a potential to increase inequity globally,” Blue said.

There’s a big need to prioritize new jobs for those groups most affected by the pandemic, said Sharon Burrow, General Secretary of the International Trade Union Confederation (ITUC).

“Decent jobs, especially climate friendly jobs, must be at the heart of recovery, along with rights, social protection, equality and inclusion,” Burrow said. “These are the foundations of the new social contract which the world needs to build resilience now and for the future.”

The future of skills, and the current skills mismatch that threatens future growth, came up as an important topic of discussion as well. In the US, for example, there are over one million open jobs, but there are not enough people with the requisite skills to fill them.

As CEO of Stanley Black & Decker, James M. Loree has witnessed the effect of skill shortages. As part of its growth strategy, the company has committed to empowering ten million makers by 2030. Many of the firm’s plants rely on local workforces and he sees the reskilling and upskilling of these existing local workforces via local public/private partnerships as a solution.

Access to learning via digital channels will further ease skills shortages, and ultimately, the labour market challenges they create.

“Digital jobs that people need to reskill for can be learned on digital platforms. It is very affordable, and easily accessible from anywhere,” Jeff Maggioncalda, CEO of Coursera Inc, said. “Jobs opportunities, too, will become increasingly available, and not necessarily in the same local area, or even the same country. If we can have learning for anyone, and job opportunities for anyone, that creates a fairer distribution of leaning and work.”

Companies face added challenges from job seekers, particularly younger people, who only want to work for companies that align with their values. Allen Blue said that candidates are increasingly targeting companies that are committed to ESG, have a greater awareness of social issues, and are a force for good in society, which could potentially impact talent-hungry labour markets.

All were agreed on the immediate need to address a social revival alongside an economic one.

“There can be no economic recovery without a social one”, said Saadia Zahidi, Managing Director, World Economic Forum.