The Swiss job market continued its unabated growth in 2022: 23% more job adverts than in the previous year

Zurich, 17 January 2023 – Despite inflation, the energy crisis and a sluggish global economy, the Swiss labour market closed out the year on a high. Comparing job adverts from the entirety of 2021 with those from 2022 reveals that the job market has grown once again this year, both across Switzerland as a whole (+23%) and in the majority of Swiss major regions. These are the scientifically substantiated findings of the Adecco Group Swiss Job Market Index and the University of Zurich’s Swiss Job Market Monitor.

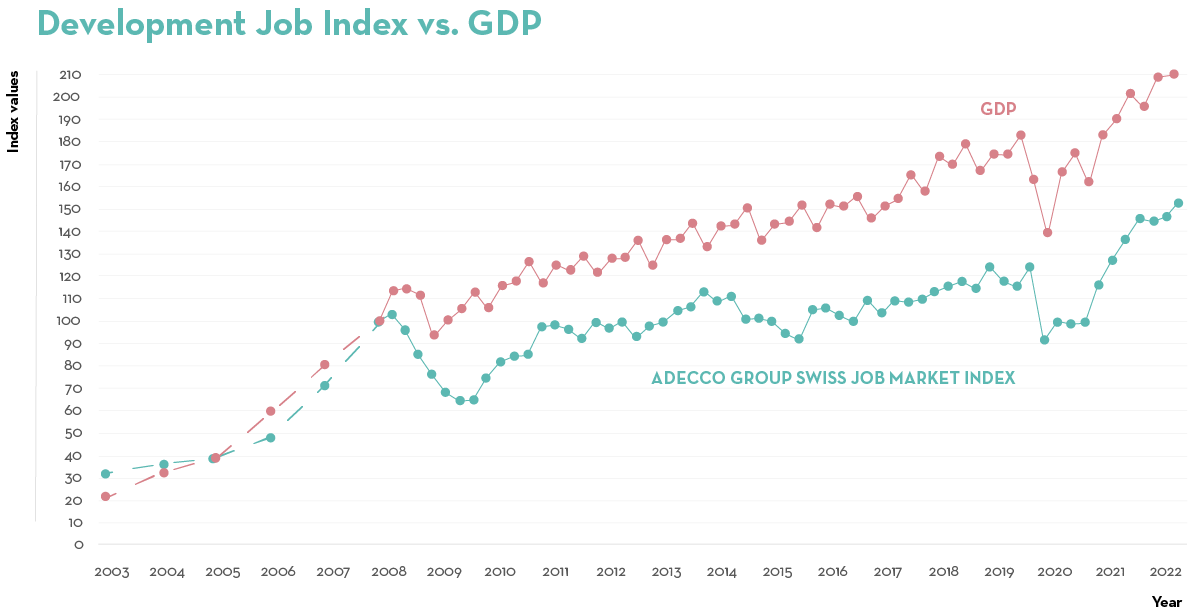

Despite all the crises and challenges that 2022 brought with it, the Swiss job market is wrapping up 2022 with 23% more job adverts than in 2021. In terms of quarterly changes, Q4 2022 saw 13% more job ads than Q4 2021. The Adecco Group Swiss Job Market Index has increased by 5% compared to the previous quarter (Q3 2022), hitting another record high.

"The Swiss job market closed out 2022 in top form. The number of job advertisements remained stagnant at a high level over the first three quarters of 2022, but this figure once again headed upwards in the last quarter, with the Job Index reaching an unprecedented high. Despite signs of an economic slowdown, Swiss companies are continuing their hiring spree. This is also confirmed by the JOBSTAT employment forecasts and the’’ KOF employment indicator. Both indicators remain within the growth area, thereby indicating that employment levels are on the up."

Marcel Keller, Country Head at Adecco Switzerland

Strong surge in demand for service and sales professionals

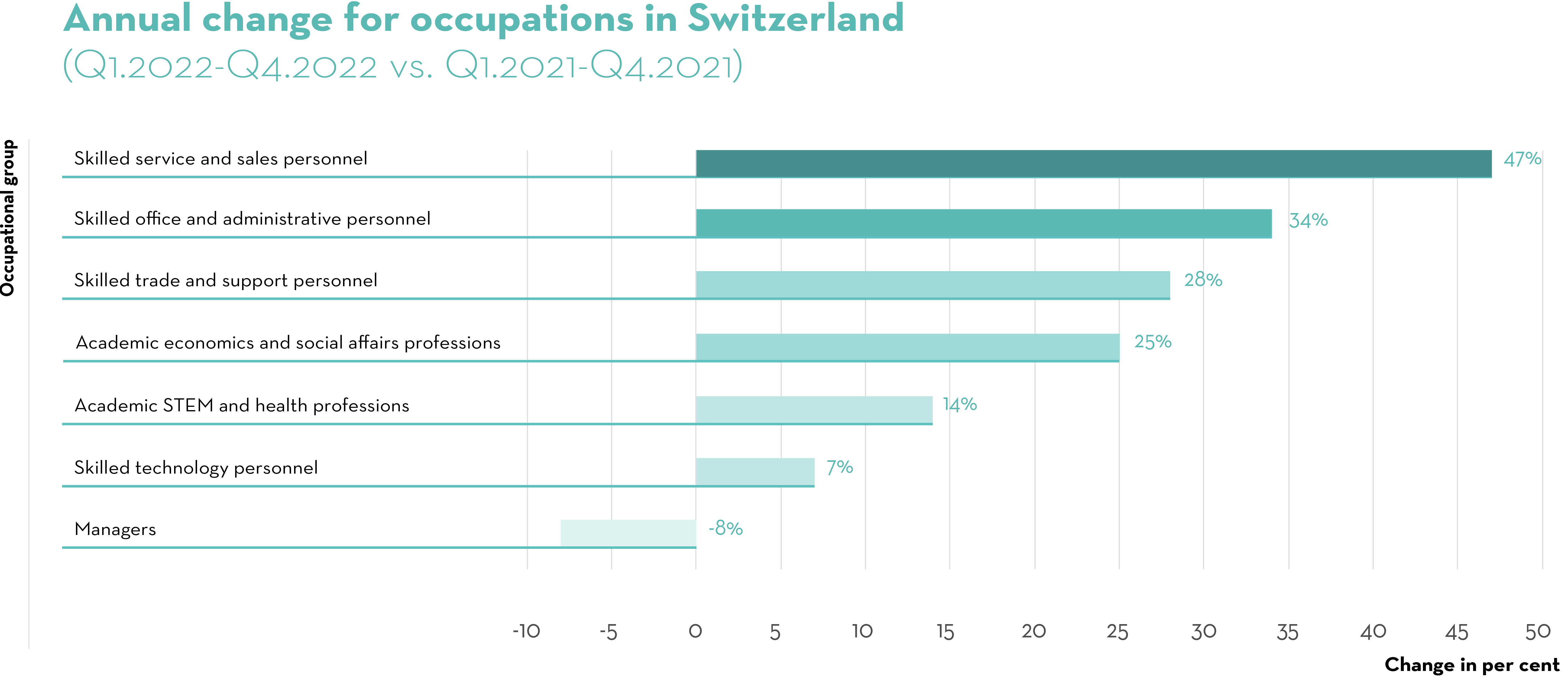

A comparison of job adverts from the entirety of 2021 with those from 2022 demonstrates that the majority of professional groups saw a clear increase in the number of jobs this year. Skilled service and sales personnel (+47%),which include hairdressers, nursing assistants and retail staff, for example, saw an especially sharp increase in demand. Within these professional groups, demand for chefs and service staff rose particularly strongly year-on-year.

Skilled office and administrative personnel spécialistes bureau et administration (+34%) which include customer advisors, payroll specialists and HR clerks, also experienced strong growth, with job adverts for customer-facing office staff (e.g. customer service workers, travel agents, receptionists and call-centre agents) seeing a particular uptick. Skilled trade and support personnel (+28%)such as polymechanics, powerline workers and chauffeurs, also recorded an above-average increase, as did academic economics and social affairs professions (+25%), which include editors, primary teachers and product managers.

"On the one hand, the heightened demand for service and sales professionals was sparked by a veritable race to make up for lost time in the food and beverage and tourism sectors after COVID restrictions were lifted in spring. For instance, the Federal Statistical Office stated that the number of overnight stays between January and October 2022 increased by a hefty 29% compared to the previous year. On the other hand, both skilled service and sales personnel and skilled office and administrative personnel benefited from robust domestic demand..This demand means that the service sector is seeing an increase in incoming orders – despite the economic slowdown abroad – which, in turn, underpins the need for these specialists."

Marcel Keller, Country Head at Adecco Switzerland

Demand for academic STEM and health professions (+14%), which include data scientists, architects and consultant doctors, and skilled technology personnel (+7%),such as CAD draughtspeople, construction managers and IT support staff, grew to a slightly lesser extent. Nevertheless, within academic STEM and health professions, demand for doctors, nurses, scientists, mathematicians and engineers increased substantially this year. In terms of skilled technology personnel, it was primarily specialists in engineering and similar fields (e.g. designers, structural draughtspeople and electrical planners) who saw a considerable surge in demand.

Management (-8%) represents the only professional group to develop negatively over the course of the year. Within the professional group of management, a distinction can be drawn between the sub-groups of managers (e.g. key account managers, business development managers and digital marketing project managers) and executives (e.g. chief financial officers, communal parliament presidents and managing directors). The sub-group of managers was the driver behind the negative development of the professional group as a whole. Job ads for the managers sub-group experienced a sharp decline at the outbreak of the coronavirus pandemic and have remained at a low level ever since. Unlike the managers sub-group, the executives sub-group has remained at a stable level as time has gone on.

Substantially more job adverts in Eastern Switzerland and the Espace Mittelland

This year, the job market experienced further growth, both across Switzerland as a whole (+23%) and in the majority of the country’s major regions, as illustrated by comparing job ads from the entirety of 2021 with those from 2022. The biggest growth, by far, was to be found in the major regions of Eastern Switzerland (+39%) and the Espace Mittelland (+38%) followed by Zurich (+27%). A less marked, but still positive, increase in job adverts was also seen in Southwestern Switzerland (+19%) and in Central Switzerland (+12%) Northwestern Switzerland (-3%)brings up the rear, making it the only major region to remain stagnant this year at a similar level to 2021.

While the Espace Mittelland, Zurich and Central Switzerland regions saw skilled service and sales personnel (Espace Mittelland: +87%, Zurich: +57%, Central Switzerland: +50%) derive particular benefit from the growth in the job market, skilled office and administrative personnel came out top in Eastern Switzerland and Southwestern Switzerland (Eastern Switzerland: +77%, Southwestern Switzerland: +47%). In Northwestern Switzerland, academic economics and social affairs professions were the main beneficiaries, to the tune of 19% more jobs than in 2021.

"Eastern Switzerland and the Espace Mittelland made a decisive contribution to the growth in the number of jobs on the Swiss labour market this year. According to the Economic Board of Eastern Switzerland, the majority of companies in Eastern Switzerland believed their staffing levels were too low in Q4 2022. Companies in the hospitality industry, wholesale sector and other service fields, in particular, mentioned their need to expand their workforce. The Espace Mittelland region, a key tourist area with a strong service sector, is currently deriving the most benefit from the lifting of coronavirus restrictions in spring and from strong domestic demand. This is reflected in the marked uptick in demand for skilled services and sales professionals across the region

Yanik Kipfer, Swiss Job Market Monitor

Side note: the proportion of employees in each occupational group

Distribution of employees by occupational group (as at 2020)

Occupational group | Total (in 1000) | ` Percentage |

22% | Skilled trade and support personnel | 947 |

18% | Skilled office and administrative personnel | 782 |

17% | Skilled service and sales personnel | 719 |

15% | Academic economics and social affairs professions | 644 |

11% | Academic STEM and health professions | 479 |

11% | Management | 450 |

5% | Skilled technology personnel | 208 |