Swiss job market stagnating – in the spotlight: office and administration professions and how they are affected by AI

Zurich, 23 October 2025: The number of job vacancies only saw a slight drop in the third quarter of 2025: -0.2% compared with the previous quarter and -5.6% compared with the same quarter of the previous year. This drop remains moderate despite a virtually stagnant economy. This report has an occupational focus on office and administration professions, which are particularly under pressure from automation and the use of AI.

This is shown by the Adecco Group Swiss Job Market Index, a scientifically substantiated study conducted by the Adecco Group Switzerland and the Swiss Job Market Monitor of the University of Zurich.

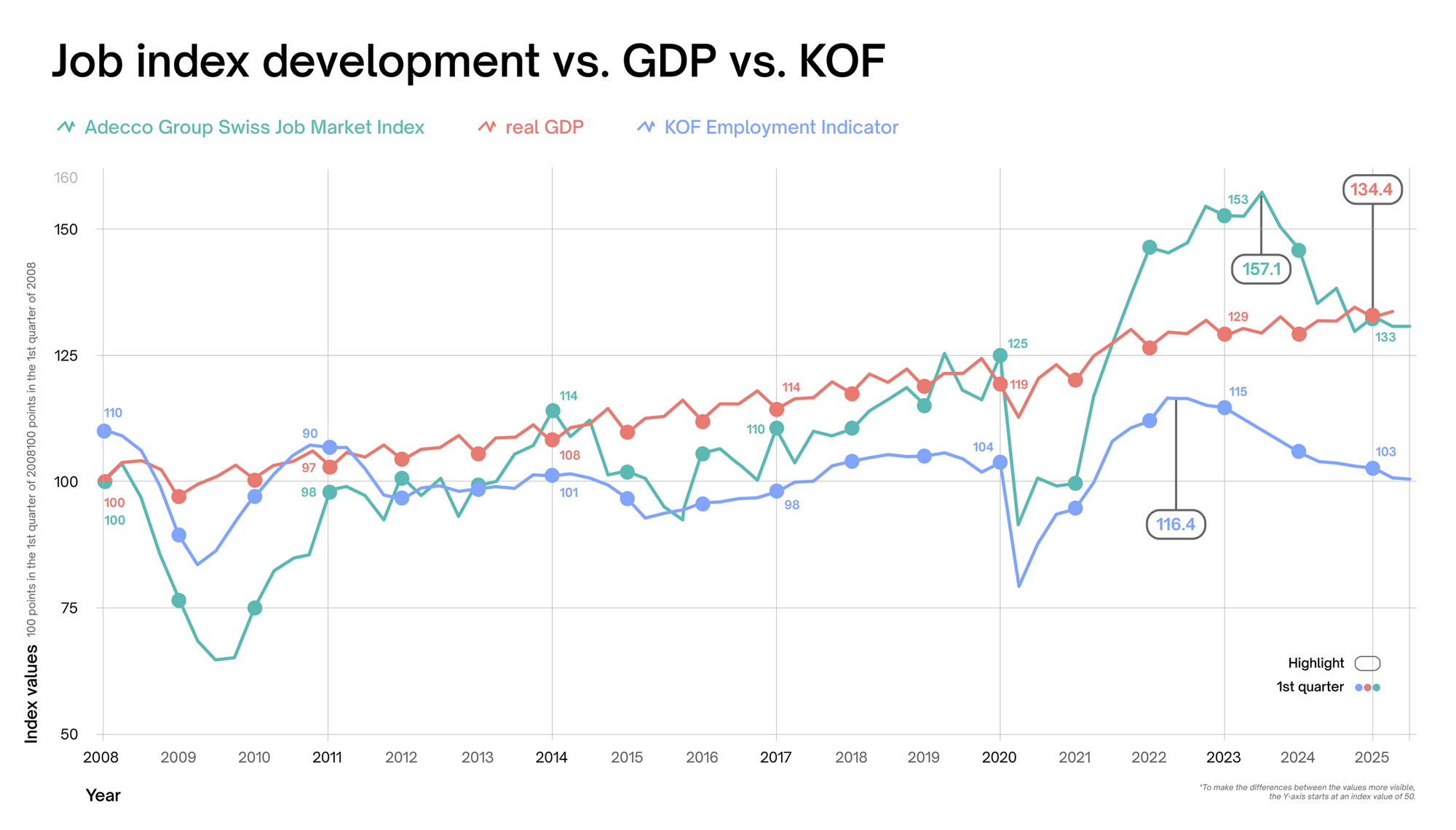

Sources: KOF Swiss Economic Institute (KOF Employment Indicator), State Secretariat for Economic Affairs (SECO; real GDP), Swiss Job Market Monitor (SMM; Adecco Group Swiss Job Market Index). NB: An Adecco Group Swiss Job Market Index or GDP value over 100 indicates an increase and a value under 100 indicates a decrease compared with the base quarter of Q1 2008. A KOF Employment Indicator value over 100 means that more companies are planning to create rather than cut jobs. If the value is under 100, job cuts are predominantly planned. The Swiss labour market stagnated in the third quarter of 2025. The Adecco Group Swiss Job Market Index showed a small 0.2% drop in the number of job vacancies compared with the previous quarter (Q2 2025). The index value was 5.6% below the same quarter of the previous year (Q3 2024). In addition, the KOF Employment Indicator showed that companies remained reticent about recruitment in light of the global economic situation.

‘According to the KOF Economic Forecasts Report, the Swiss economy virtually ground to a standstill in the second quarter of 2025, burdened by declining exports and higher additional US tariffs. Despite this, the number of job vacancies only saw a small drop in the third quarter of 2025 (as shown in the Job Index) and the unemployment rate only rose slightly. This could be due to the stabilising effect of consumer behaviour and the introduction of short-time working.’

Marcel Keller, Country President Adecco Group Switzerland

Occupational focus: changes to office and administration professions

Office and administration professions ensure the smooth running of key processes in the public and private sectors and are therefore vital to the functioning of the Swiss economy. Although the number of staff dropped by nearly 7% during the 2010-2024 period, in 2024 almost 12% of the entire working population were working in these professions. Training as an EFZ business specialist is also by far the most popular apprenticeship occupation in Switzerland.

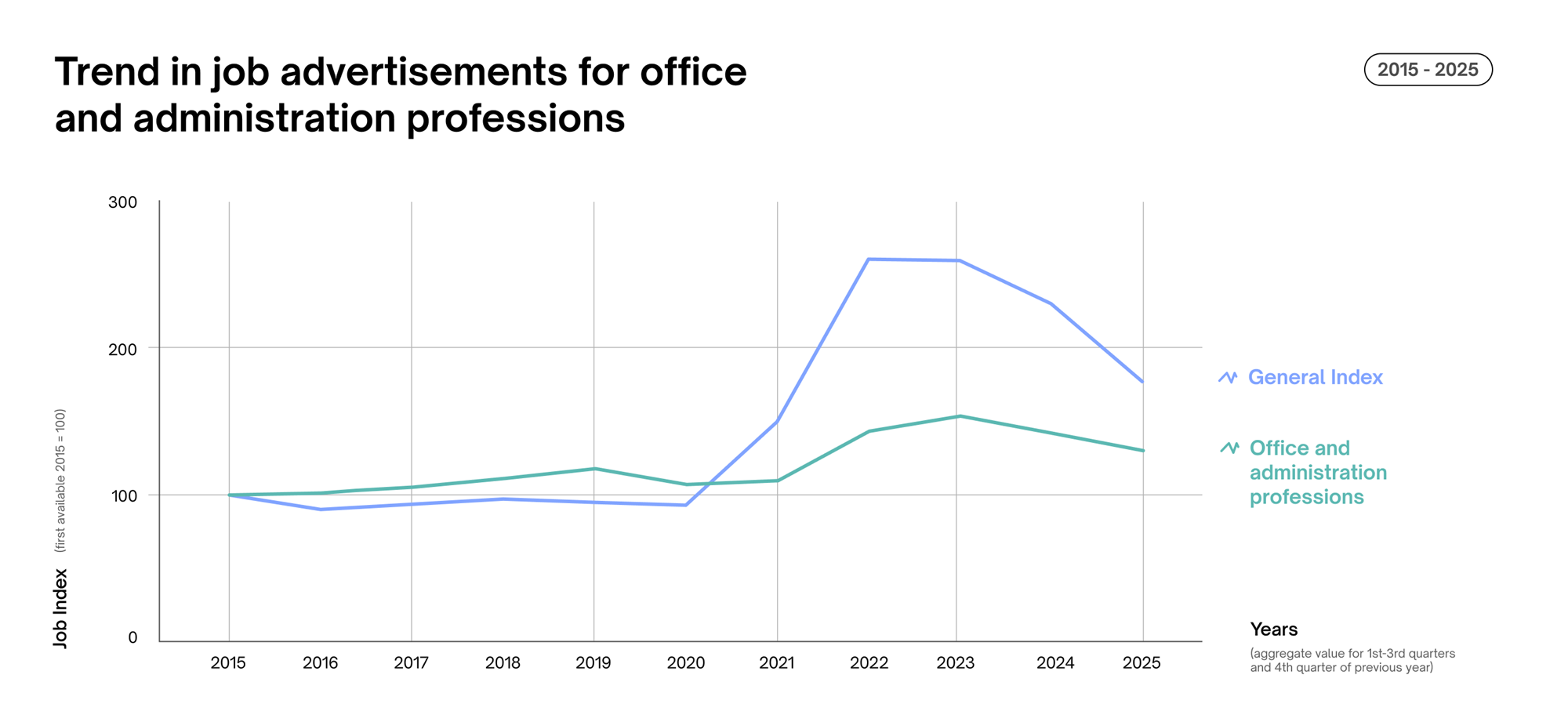

The development in the number of job vacancies in office and administration professions during the 2015-2025 period can be split into three sub-periods (figure 1). From 2015 to 2020 the number of job advertisements declined somewhat, but it then rose disproportionately in the years 2021 and 2022 compared with the total number of job vacancies. It has been continually dropping since 2023, in 2023-2025 (average -17.4% per annum, p. a.) even decreasing more significantly than the overall index (-7.8% p.a.). Given the overall decline in employment (including in 2021/2022), there is much to suggest that the 2021/2022 increase in job advertisements was primarily to fill already existing positions that were vacant, e.g. following (early) retirement or a change of job.

Figure 1 NB: The annual figures given are aggregate values. This means, for example, that the index value for 2025 includes the data from the first three quarters of 2025 and the last quarter of 2024. Further information can be found in the ‘Methods and data’ section.

In contrast to office and administration professions, which have seen a broad, structural decline in demand since 2023, the job market in some other occupational groups has shown a cyclical trend. Job advertisements for professions in hospitality or the hotel industry – which experience strong fluctuations in demand and seasonality – fell until 2021, recovered strongly in 2022-2024 and then saw a downward correction in 2025. In wholesale and retail, demand for jobs increased until 2024 and then fell in 2025, but still remains higher than before the crisis. The drop in jobs in machinery, electrical and metalwork professions (which were expanding until 2023) and in information technology (which has been declining since 2023 following strong growth until 2022) points to structural change beyond the cycle, driven by weaker foreign trade and increased efficiency from automation and generative artificial intelligence.

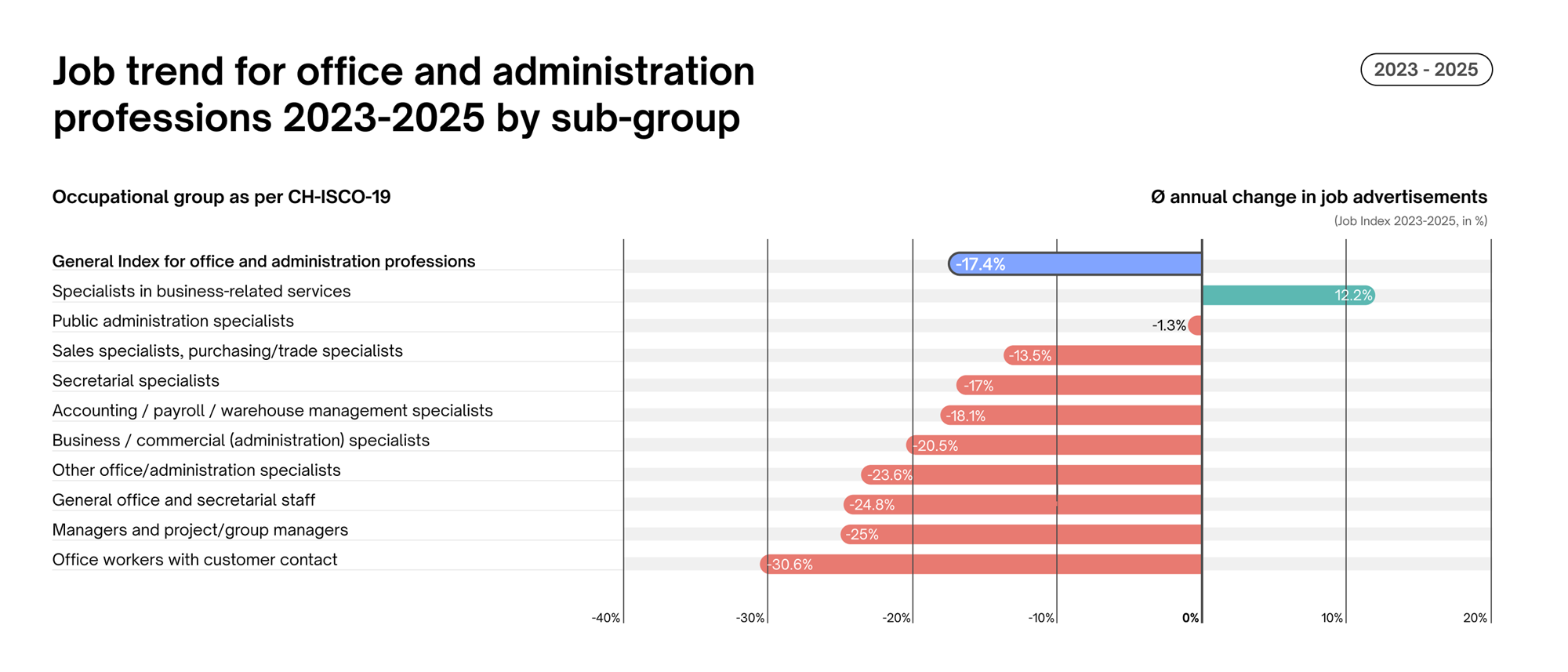

Figure 2 NB: This shows the average annual change between 2023 to 2025 as a constant annual rate. Negative values mean a drop, positive values mean an increase in jobs.

The general decline in jobs advertised in office and administration professions (-17.4% p.a.) in 2023-2025 can be seen across all sub-groups, with the exception of specialists in business-related services (accounting and freight forwarding services, conference/event planning, employment and personnel recruitment, or real estate management and agents), which saw an increase in jobs (+12.2% p.a.; see figure 2). Various roles in this sector serve as the driving force behind this increase, including arranging business contacts and services (e.g. advertising space), contract arrangement for performances (agents, intermediaries such as artist/athlete agents), production and publications (literature/publishing agents), the sale of assets at auction (auctioneers) and travel arrangement.

What makes this sub-group special is that such activities are often fiducial, contractual or intermediary, and involve specific expertise and industry links. Areas seeing a less significant decline in job advertisements than the average for the occupational group overall were public administration professions (-1.3% p.a.; tax and social administration, customs/passport and licence offices, and police department / criminal office), sales specialists / purchasers / brokers (-13.5% p.a.) and secretarial specialists (-17% p.a.). Significant pressure was felt in the professions of accounting / payroll / warehouse management (-18.1% p.a.), business & commercial (administration) specialists (-20.5% p.a.), other office/administration specialists (-23.6% p.a.; filing/documentation, human resources, library assistant / coding / proofreading, mail distribution), general office and secretarial staff (-24.8% p.a.; general office staff, secretaries, typists / data entry) and managers / project & group managers (-25% p.a.; senior administrative staff, finance/HR managers, business planning, project/group management). However, office workers with customer contact were the most affected by the decline in jobs (-30.6% p.a.; counter staff, call centre, reception, information or travel services). Overall, this represents a broad decline, with only the business-related services segment seeing an increase and public administration remaining essentially stable.

These changes to the job market suggest that office and administration professions are increasingly feeling the pressure. This then raises the question of what role automation and artificial intelligence are playing in this process.

Automation and AI are intensifying structural change in office and administration professions

Digitalisation, automation and, increasingly, the use of artificial intelligence (AI) are primarily lowering demand for very routine, rule-based activities. Of all the occupational groups, office, administration and secretarial professions are particularly under threat from technological change as they involve a high proportion of routine cognitive tasks, such as data entry or standardised processes, which studies show are increasingly being replaced (Autor, Levy & Murnane 2003; Gschwendt, 2022). At the same time, this occupational group is seeing the emergence of new tasks (coordination, communication, quality control, data/process management), meaning that jobs are not simply disappearing, but also changing, with new, complementary tasks developing (Acemoglu & Restrepo 2019). Generative artificial intelligence (AI) also means that cognitive tasks such as text generation, summaries and the provision of information – which are key to office, administration and secretarial professions – are under pressure from automation (Cazzaniga, 2024). The use of (generative) AI could make workers more productive and therefore increase demand for specialists, or alternatively replace workers and reduce demand; which effect will win out remains to be seen.

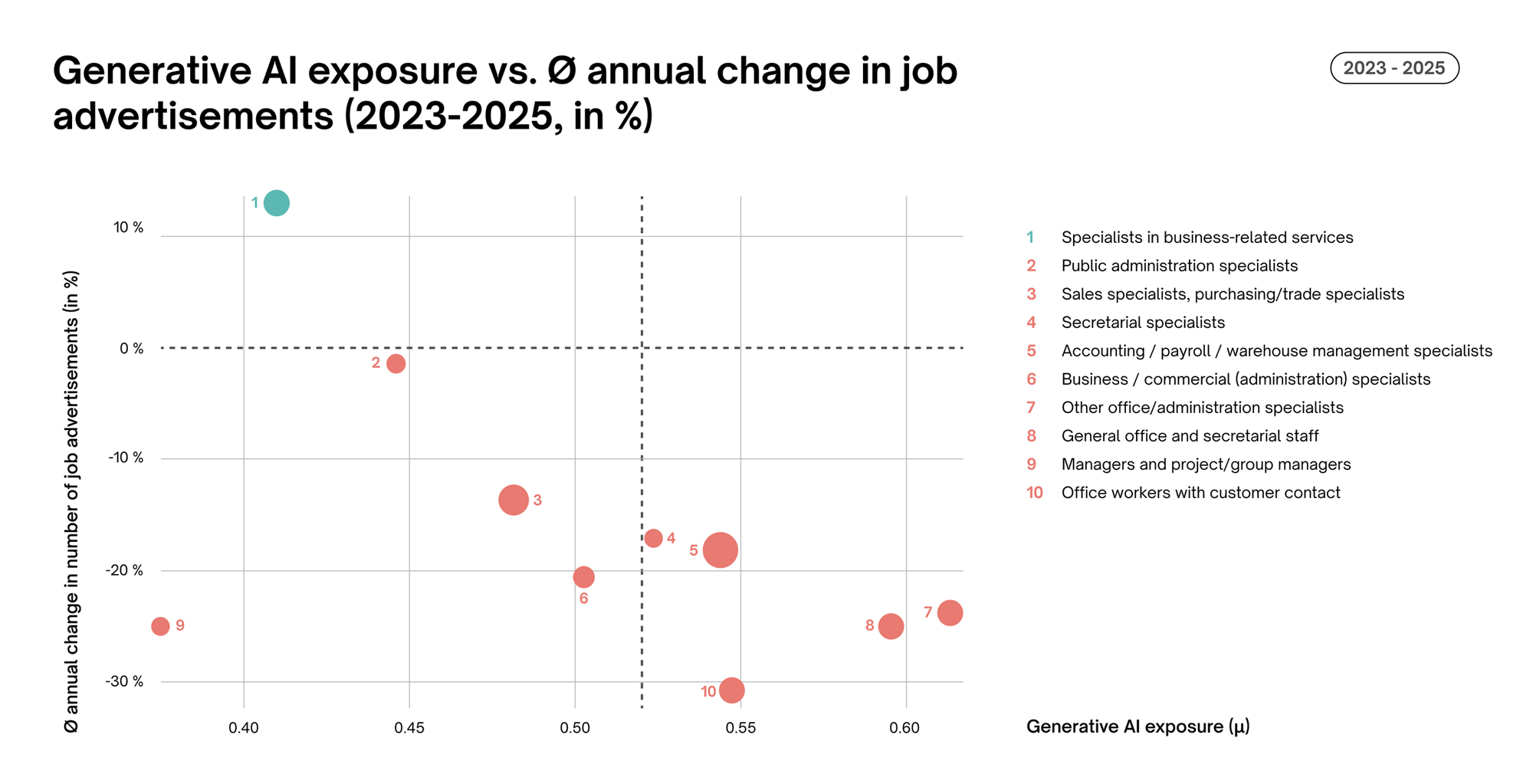

To gain an idea of how generative AI is affecting demand for office and administration professions, figure 3 illustrates the correlation between the number of job advertisements in this professional group and their exposure to generative AI. This has been quantified by the Global Index of Occupational Exposure International Labor Organization (ILO). It quantifies professions’ exposure to generative AI and demonstrates where there is particularly high (high index value) or low potential for automation. Occupational groups with high AI exposure would be expected to see lower job growth. As the large-scale use of generative AI is a very recent phenomenon, e.g. the introduction of OpenAI’s ChatGPT in November 2022, this report only examines job advertisement trends in the period 2023-2025.

The horizontal axis in figure 3 shows the generative AI exposure of office and administration professions, whilst the vertical axis illustrates the average annual change in the Job Index during the period 2023-2025. The occupational groups of general office and secretarial staff, other office/administration specialists, office workers with customer contact, secretarial specialists, accounting / payroll / warehouse management specialists, and business / commercial (administration) specialists have above-average to high exposure to generative AI and have also seen a downward trend in job advertisements. This makes them some of the occupational groups most heavily at risk from generative AI.

Figure 3 NB: The vertical dotted line in the diagram indicates the average exposure to generative AI across all occupational groups depicted. Dots left/right of the line = professions with below/above average exposure to AI. The size of the dot indicates the significance of the occupational group (number of observations). μ ≥ 0.6 – high average exposure (many tasks with high potential for automation); 0.5 ≤ μ < 0.6 – above-average exposure; 0.4 ≤ μ < 0.5 – medium exposure; μ < 0.4 – low average exposure.

Sales specialists, purchasing/trade specialists and public administration specialists sit in the middle section for AI exposure, but also saw a declining trend in job advertisements during the 2023-2025 period. Despite the lack of technological pressure in this area, demand is still stagnating. One striking feature is the position of managers and project/group managers: despite low AI exposure, these positions also saw a drop in the number of jobs advertised. This indicates that it is not only technological factors that play a role here, but also organisational and economic developments. One exception is specialists in business-related services (accounting and freight forwarding services, conference/event planning, employment and personnel recruitment, or real estate management and agents). These only have moderate exposure to AI, but have seen a significant increase in job advertisements. This professional field seems to have profited from the digital and organisational changes brought about by AI, rather than being threatened by them.

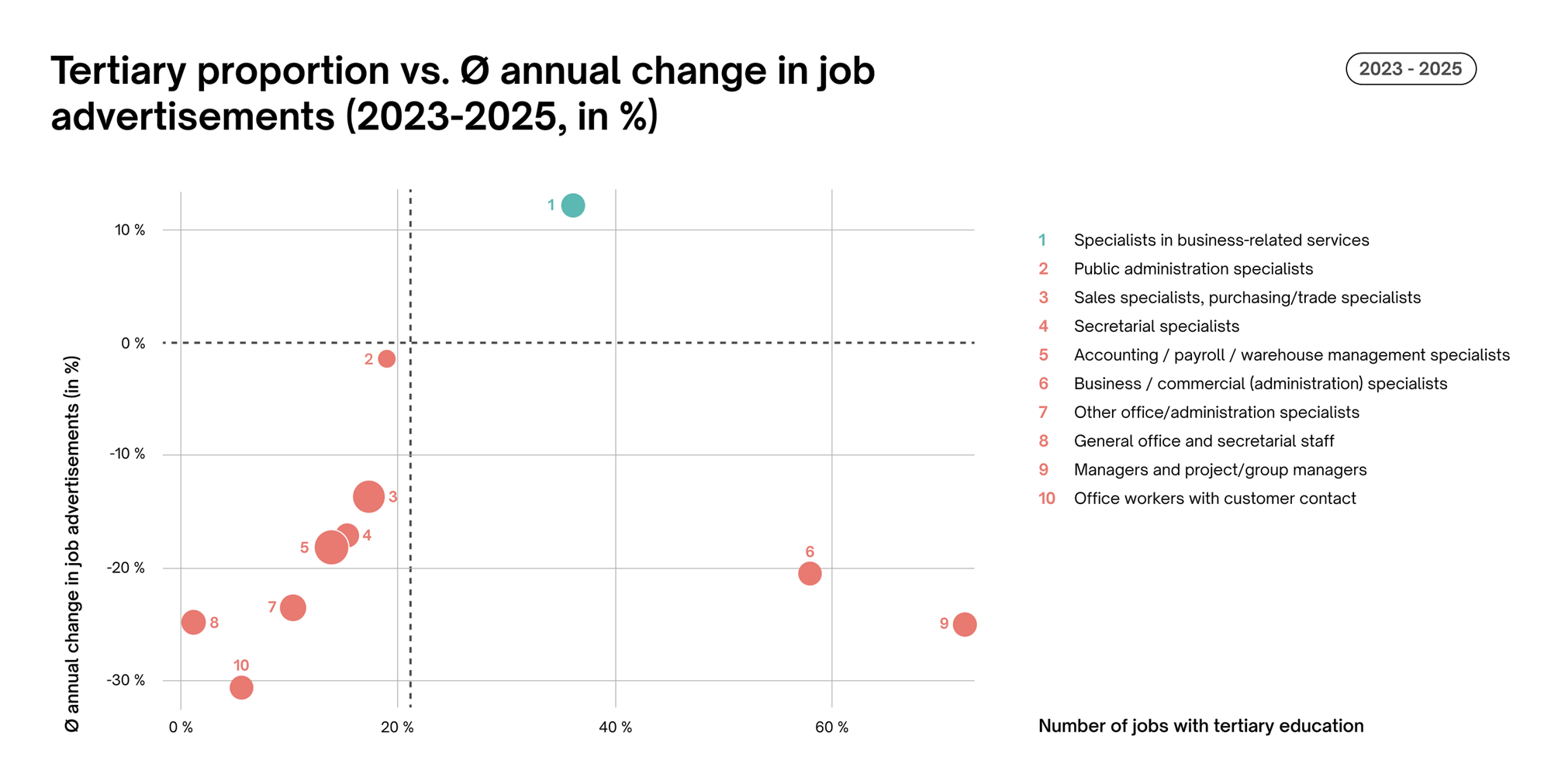

Studies have shown that more highly skilled activities are harder to automate and will instead benefit from technological upheaval in the long term (Autor, Levy & Murnane 2003; Lane, Williams & Broecke, 2023). However, the use of generative AI is increasingly also putting highly skilled jobs under pressure of automation (Cazzaniga, 2024). Figure 4 therefore examines the proportion of job advertisements requiring a tertiary education, as representative of more highly skilled activities (horizontal axis), and then relates this to the average annual change in the number of job vacancies during the 2023-2025 period (vertical axis). This illustrates which occupational groups are more heavily reliant on workers with tertiary qualifications and how job opportunities for these occupational groups are developing, especially given the increased use of generative AI since 2022.

One particularly striking element is specialists in business-related services, which have a medium tertiary proportion paired with a significant increase in job advertisements, and thus represent an exception to the generally declining trend. By contrast, professional groups with an above-average tertiary proportion such as managers and project/group managers or business and commercial (administration) specialists saw a marked drop in job advertisements. The same also applies to occupational groups with a below-average tertiary proportion, such as general office and secretarial staff, office workers with customer contact, or other office and administrative specialists. Only public administration specialists seem mostly unaffected by the decline in jobs. It would therefore appear that overall, jobs with higher qualification requirements such as managers and project/group managers have not been spared the decline in demand for job advertisements, alongside professions with basic qualification requirements.

Conclusion

The results indicate a structural drop in demand for office and administration professions since 2023, especially in professions with a high proportion of routine and rule-based activities and high exposure to generative AI. One striking element is the opposite trend for professions in business-related services (e.g. mediation / organisation / real estate): despite only moderate exposure, job advertisements saw a significant rise in the period 2023-2025, suggesting complementary effects (coordination, interface work, project-related services). What makes this sub-group special is the fact that it involves fiducial, contractual or intermediary activities that require specific expertise, negotiating skill, industry contacts, and experience in contract administration, marketing and rights management – activities that are not easy to replace with generative AI. Jobs for managers and project/group managers are also declining, even with lower AI exposure. Organisational streamlining, economic slowing and efficiency gains all tend to indicate non-technological driving forces in this area.

A high tertiary proportion, as representative of higher qualification requirements, does not automatically provide protection against declining demand as, for example, demonstrated by managers and project/group managers. Nevertheless, many occupational groups with a high level of AI exposure and a low tertiary proportion (as representative of professions with basic qualification requirements) saw significant drops in job advertisements.

The results therefore suggest that companies could increasingly use digital solutions such as workflow tools or generative AI to cushion routine tasks, such as automatically importing invoice data. At the same time, human work is increasingly in demand in areas such as exception handling, coordination and quality assurance. There is also increasing demand for further training and retraining opportunities, especially in data and process skills, AI-assisted text and document work, and compliance and data protection.

In methodological terms, it should be emphasised that the 2023-2025 observation period sees generative AI at an early adoption phase. Identifying clear, robust structural changes would require a longer timescale. Nevertheless, the findings of this study are consistent with technologically-driven structural change, although they do not permit any causal attributions.

‘The descriptive evidence in this report shows trends indicating fewer job advertisements for AI-exposed, routine office and administration professions. At the same time, there is much to suggest that generative AI will complement human work and reshape its nature rather than completely replacing it, creating new skill requirements and challenges as regards inequality, retraining and job quality.’

Johanna Bolli-Kemper, Swiss Job Market Monitor

Methods and data

The office and administration profession trends presented here are based on Adecco Group Job Index data for the period from the fourth quarter of 2015 to the third quarter of 2025. These quarterly data include market data from the 11 largest Swiss job portals as well as company data from approximately 1500 company websites, which are a representative sample for Switzerland stratified by industry and company size. Press advertisements were also surveyed up until the first quarter of 2018.

The index values were calculated on the basis of annual data, i.e. they each cover four combined quarters. This was in order to ensure sufficient case numbers. In order to meet the publication date and satisfy a desire for the information to be up to date, the fourth quarter of the previous year was combined with the first three quarters of the current year to form an annual value. This means that the index value for the year 2025, for example, comprises the first three quarters of 2025 and the last quarter of 2024.

The Global Index of Occupational Exposure from the International Labor Organization (ILO) breaks jobs down into tasks and assesses the extent to which they can be automated by generative AI, based on surveys and expert judgements. AI models are used to transfer these assessments to tens of thousands of activities and combine them with international labour market data. The index quantifies professions’ exposure to generative AI and demonstrates where there is particularly high (high index value) or low potential for automation.

Documents

Access the full study incl. sources here Study Job Index Q3 2025

Find the key results in the Press Release Q3 2025