Number of available positions once again hits record level from 2014 – Demand for IT staff on the rise over the past year

Number of available positions once again hits record level from 2014 – Demand for IT staff on the rise over the past year

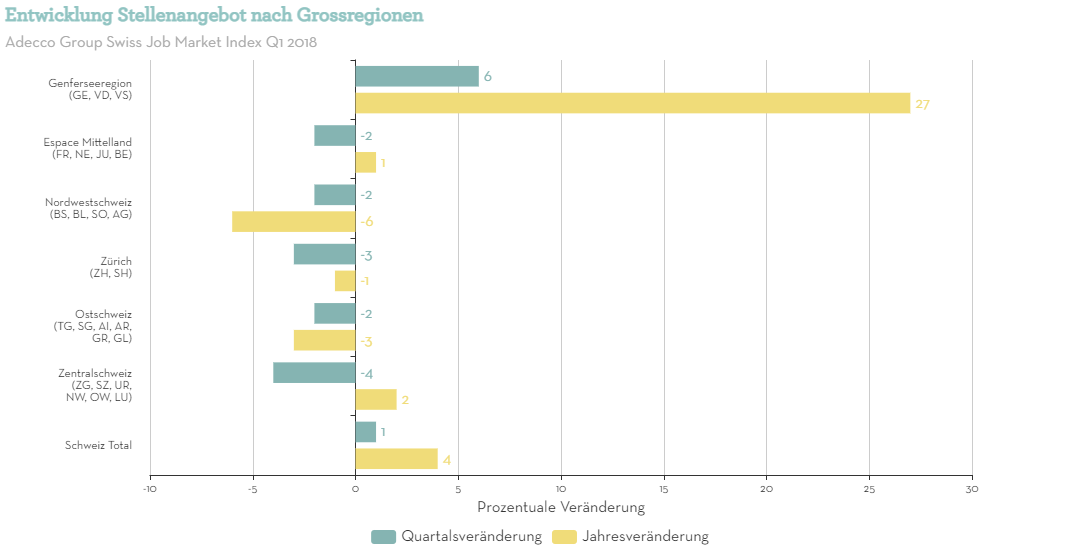

Zurich, 6 April 2018 – Swiss companies published 4% more job advertisements in the first quarter of 2018 than in the previous year. This is reflected in the scientifically substantiated survey of the Adecco Group Swiss Job Market Index conducted by the Swiss Job Market Monitor from the University of Zurich. This increase in job advertisements was driven mainly by strong growth in the Lake Geneva Region, while the majority of the other regions have stabilised at a high level. The rise in IT jobs observed during the previous quarters continues.

The Adecco Group Swiss Job Market Index was 4% higher in the first quarter of 2018 than in the spring of the previous year. It remained at a high level (+1%) compared to the last quarter. Seasonally adjusted, however, the index was slightly lower compared to the last quarter, since the latter was unusually strong. Overall, excellent economic development in Switzerland is driving the number of job vacancies. Nicole Burth, CEO of The Adecco Group Switzerland, commented: “Over the last quarters, an increasing number of jobs were advertised in the IT job group in particular. It is not always easy to fill IT positions successfully, which is why these advertisements remain posted over a relatively long period.”

Lake Geneva Region on a roll

Lake Geneva Region on a roll

Unusually strong growth in the area of job advertisements was seen in the Lake Geneva Region. Companies in this region posted 27% more job advertisements in the first quarter of 2018 than they did in the first quarter of last year. “In 2016 we were already seeing the first rise in the number of job advertisements in this region. In general, this trend reflects the positive economic climate in the Lake Geneva Region. The boom in the Swiss export market in particular is having a great impact on the Lake Geneva Region,” explained Jan Müller from the Swiss Job Market Monitor at the University of Zurich. In comparison to the first quarter of 2017, the number of job advertisements in almost all of the other regions remained stable at a high level. Only marginal changes could be seen in Central Switzerland (+2%), Espace Mittelland (+1%), the Greater Zurich Area (-1%), and in Eastern Switzerland (-3%), while the number of job advertisements in Northwestern Switzerland decreased (-6%).

In contrast to the Lake Geneva Region, Northwestern Switzerland has seen a slight decrease in the number of advertised jobs (-6%). This development was mainly due to a fall in staffing demand for personal and social services jobs (-13%). On the other hand, the development in technology and IT jobs in Northwestern Switzerland has also been following the Switzerland-wide positive trend with 12 percent growth being achieved. A longer-term observation of the region’s development shows overall that an unusually high number of jobs was advertised in the same quarter of the previous year, and that the current overall number of jobs should not be seen as decreasing, but rather as stabilising, which is similar to the rest of German-speaking Switzerland.

REGIONS

High demand in IT professions and in industry and transportation

Since 2017, the fields of industry and transportation have also been displaying a steady rise in job advertisements once again. Job advertisements in these job groups fell sharply in 2015 due to the sudden devaluation of the Swiss franc. Compared to the previous year, the number of vacancies rose remarkably once more with an increase of 9%. “For the most part, the economy has recovered from the franc devaluation, resulting in more jobs being created and advertised. The industry and transportation job group, which is very export-dependent, demonstrates this very clearly,” Burth explained.

When compared to the previous year, however, the job advertisements in the office and administration sector showed a decrease (-16%). Nevertheless, because the demand in this sector rose slightly once again compared to the previous quarter (+3%), it would appear that the negative trend that began mid-2017 has ended. “Whether or not and to what degree the demand recovers in the office and administration sector remains to be seen during the coming quarters. We believe that a number of these professions will become increasingly automated based on advancing digitisation,” Burth remarked. With a drop of 11% compared to the first quarter of 2017, demand in the construction and renovation industry also shrank. Following the very strong demand in the construction sector between the end of 2016 and the autumn of 2017, the market is now indicating a degree of saturation. “The number of job advertisements could once again even out at a similar level to mid-2016,” Müller elaborated.

Focus on Ticino: Intensity of recruiting in

Ticino

As evidenced by a current Swiss representative survey of Swiss companies conducted by the Swiss Job Market Monitor of the University of Zurich in the spring of 2018, the percentage of companies with vacant positions lies at 10% overall in Switzerland, but is significantly lower in Ticino. The number of vacancies per company in Ticino is therefore also considerably lower than in other regions in Switzerland. “The above-average number of small companies found in Ticino advertise for new staff far less often than larger enterprises do. This means that the average number of vacant positions per company in Ticino is comparatively low,” explained Müller. However, if only those companies who were looking for employees at the time of the survey are considered, the difference disappears. The average number of job advertisements per company in Ticino is then no longer any lower than in the rest of Switzerland.

* The data of the scientifically substantiated survey of Swiss companies by the job market monitor for Switzerland of the University of Zurich are representative across Switzerland. This is not true for a region as small as Ticino.

GRAFIKEN

Entwicklung Stellenangebot nach Berufen Entwicklung Stellenangebot nach Grossregionen Fokus Tessin Entwicklung Stellenangebote nach Berufen

Gesamtindex und Teilindices

Information regarding data collection: Optimisation

Based on revisions to the Adecco Group Job Market Index for the first quarter of 2018 some of the figures listed in this media release deviate slightly from the figures published as of the first quarter of 2018. The revisions serve to align the index with a constantly changing job market. They pertain above all to the allocation of individual job titles to job groups and the multiple publication of job advertisements. The revisions are intended to optimise the index, and therefore do not render the earlier published figures invalid in any way